The Andrews Median line or Pitchfork is a form of tool that is used to identify potential reversals or continuation of trends. The median line tool is one of the standard charting tools available with most trading/charting platforms. Developed by Alan Andrews on the concepts of Roger Babson and made famous by various other traders such Tim Morge, the Median line tool makes for a powerful trading method. In this article, you will learn about how to plot the median lines and how they can be traded.

What is the Andrews Pitchfork tool?

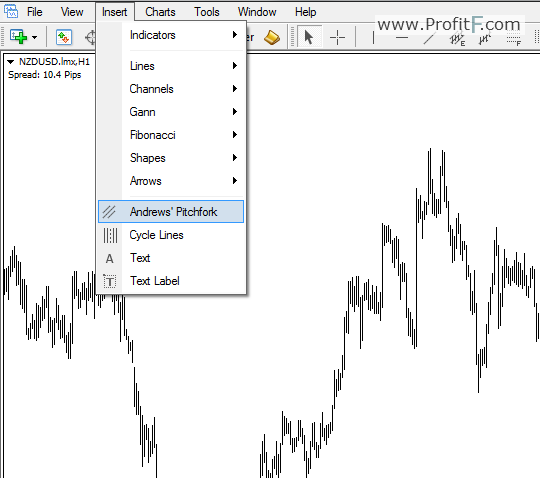

The Andrew’s Pitchfork can be accessed in the MT4 platform by clicking on Insert> and selecting Andrew’s Pitchfork.

The Andrews pitchfork tool or median line comprises of trend lines that are drawn connecting three price points. Swing high/Swing low/Swing high or Swing low/Swing high/Swing low. The median line comprises of three lines, the median line which dissects the two Swing highs or lows, and the upper and lower median lines. It is the appearance of the median lines which gives it the popular name of Pitchfork.

After identifying the swing high/low points, the Median line should be adjusted in order for the median line to make some sense. The chart below shows the pitchfork plotted which is adjusted to the swing high and low points to make sense of the price action.

The chart below is the Median line in its simplest form.

The Andrew’s Pitchfork is based on the concept of Action/Reaction and Newton’s law of “Every action has an equal and opposite reaction”.

There are different elements of the Pitchfork tool, they are:

Full Andrew’s Median line

Andrew’s Pitchfork Trading Rules

The following is a summary of the Andrews Pitchfork Trading rules.

The chart below shows an example of how well price respects the Andrew’s Pitchfork tool. As per rule #3, we see how price failed to reach the lower median line after breaking the ML, and a reversal takes place with price rallying back to the upper median line.

Trading with Andrews Pitchfork

The simplest way to trade with the Andrew’s Pitchfork tool is to buy or sell on pullbacks within the pitchfork.

The chart below shows after how the pitchfork was drawn on the chart, the pullbacks within the downtrend offered a quick opportunity to sell while booking profits at past support levels.

This market could have been continuously traded by keeping in mind the rules of Pitchfork trading. The chart below is a continuation of the above chart, where we notice price failing to reach the median line, indicating a reversal.

When a new swing high/low points are made, plotting a new median line, we can again find opportunities to buy on the pullbacks while booking profits near the recent resistance levels.

Although not mentioned in the traditional Pitchfork trading manual, the swing points and price reversals in the Andrew’s Pitchfork tool can be strong support and resistance levels. To illustrate this point take a look at the chart below. Here, support/resistance lines have been drawn at the pitchfork’s swing points as well as the last reversal in the pitchfork.

And as price progressed, notice in the next chart how price reacts to these levels that were initially drawn based on the Pitchfork tool.

Combining Andrew’s Pitchfork with other methods

The Andrew’s pitchfork tool is a versatile trading tool that can be used in combination with any other existing trading methods. Because the pitchfork tool can serve as an early indicator of trend reversals, pitchforks can be used with Channel trading or with an indicator based trading system.

The charts below show the Andrews Pitchfork tool indicated a potential reversal early on. If only the moving average was used as a trend indicator, then as you can see traders would have missed a big amount of pips in lost trading opportunity.

The next chart below shows how plotting the pitchfork within the channel offers some great insights into possible trades.

Here, we see that price is within an up sloping channel; therefore we prefer to buy near the channel lows. But what is the guarantee that the lower channel line will hold, especially after there was a fake out at the lower channel line the last time it was tested (partly shown on chart).

When we use the pitchfork tool and connect the swing points, we can see that price starts consolidating strongly near the median line as well as the lower channel line. Earlier in the article we mentioned how the support/resistance levels are stronger with the pitchfork tool.

Notice after price breaks out of the pitchfork, it rallies, only to retest the support level close to the lower channel line before rallying.

Andrews Pitchfork Trading – Conclusion

To summarize, the Andrew’s Pitchfork tool is a versatile trading tool that can be used in any market and in any timeframe. It is best when used with other trading systems or method, but can be traded as a standalone tool as well. Trading with Andrew’s pitchfork requires quite a bit of practice and more importantly patience and with good experience the possibility of developing your own custom trading system based on Andrew’s pitchfork tool should be quite simple and rewarding.