What is Swaps?

Swaps are interest rate differentials and commonly relevant in the currency markets. Of course, brokers who offer CFD’s also levy swap rates. If you are an intra-day trader where you close your trades by the end of the day, swap rates are irrelevant. However, if you are a swing trader and tend to keep your position open over a period of time, you must pay attention to the swap rates as they can add or subtract a small, yet significant amount to your trade.

As the currency markets involve a simultaneous buying or selling of one currency to another, the guiding interest rate difference for the currency pair you are trading determines the outcome. For overnight positions, you are either levied a positive swap (the swap rate is added to your trade) or a negative swap (the swap rate is subtracted from your trade).

Swap rate is defined as the overnight rollover interest for open positions

Swap rates or rollover rates are typically charged on an overnight basis and a triple rollover or triple swap rate is applied every Wednesday.

How are swap rates determined?

In theory, when you buy a currency with higher interest rate and sell a currency with lower interest rate, you are charged a positive swap. Likewise, when you buy a currency with lower interest rate and sell a currency with higher interest rate, you are charged a negative swap.

Let’s say you want to buy AUDUSD.

We know that the interest rate in Australia is at 2.5% while the interest rate in the US is at 0.5%. So when you buy AUDUSD, you are charged 2.5 – 5 = 2% swap rate. However, when it comes to actual forex trading, you won’t be paid the exact amount. The swap rates are determined by the rate the liquidity providers are willing to pay and thus could differ from the actual rates.

How to check the rollover rates you are charged?

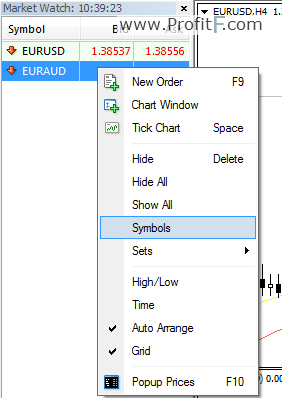

If you are trading with the MT4 platform, it is easy to check the swap rates for the currency pairs. To determine the swap rates, right-click on a currency pair in the ‘Market Watch’ window, click on ‘Symbols’ and expand the ‘Forex’ folder to view the list of currency pairs. Then select a currency pair and click ‘Properties’ to view the swap rate details.

Refer to Figure 1 and 2 for a graphical illustration on how to view the swap rates for currency pairs in the MT4 trading platform.

Figure 1: Viewing Swap Rates in MT4

Figure 2: Swap Rates, MT4

In the above example, we are viewing the swap details for EURAUD currency pair. The swap information can be understood as follows:

For a contract size of 100,000 (or 1 standard lot) the swaps are charged as follows:

For long positions (Buying EURAUD): Swaps charged are -$1.17

For short positions (Selling EURAUD): Swaps charged are $0.89

So depending on your contract size, the swaps are adjusted accordingly. For example if you were trading a mini lot selling EURAUD, you are charged $0.089 for overnight positions. If you held on to your trade for 7 days of the week, you are charged $0.089 x 4 + $0.089 x 3 (On Wednesdays) giving you a total positive swap of $0.596

The reason why you are charged a triple rollover on Wednesdays is because no rollovers are applied for positions held over the weekend (Saturdays and Sundays)

Should you really be bothered about swaps/rollovers?

For intra-day traders, rollovers aren’t much of an issue, unless you hold your positions overnight and for a prolonged period of time. In such an event, it pays to look at the swaps you are being charged and ensure that it doesn’t eat too much into your profits.

Swaps can be an additional way to earn interest on open positions, especially if a positive swap is added to your position. This way, you can at the very least manage to cover any commissions or spreads that your broker might charge you and thus virtually trade for free. Negative commissions however do add small yet additional amounts to the already paid costs of trading.