TABLE OF CONTENTS:

As a rule, a martingale is associated with something hazardous and extremely unstable. One might call it a “ticking bomb”, which is ready to explode on your deposit at any moment.

However, if single elements of the martingale are properly applied, you’ll be able to significantly enhance profitability of your trading system and thereby reduce a moral load.

The system was initially developed to be applied to roulette.

The idea behind the system is very simple. If you bet $1 on red, and roulette hits black, then you bet $2 on red. If the roulette hits black again, then you bet $4 on red. If the roulette doesn’t hit red again, then you should bet $8, $16 and so on, until you get a win.

When you win, your win will recover all your previous losses.

In theory, it all seems to be a funny and a profitable game. However, a casino puts a limit on the maximum bet. Besides, if you double your initial bet of $1 every time, it will increase up to $1024 in no time and up to $1 million in the near future.

No one casino will allow you placing such a big bet. I doubt if you take so much money with yourself. But forex broker allow placing such a big bet

(read more about Martingale Trading-method here>>)

Truly speaking, the system can be very easily applied to the Forex market. Suppose that the price moves in some way.

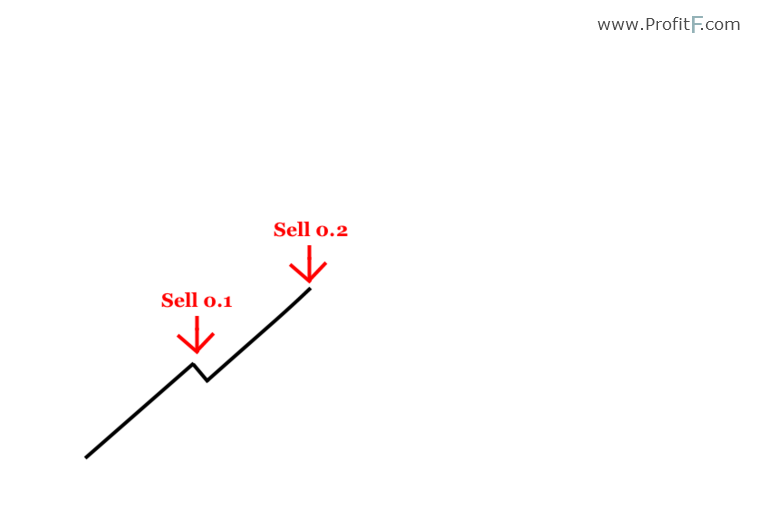

Let’s assume that the price moves upwards.

We have decided that we need to sell, since the market is in an overbought condition now.

We sell 0.1 lots:

The price continues to move with the trend and goes still higher.

We don’t close the previous position, but at that we open an additional position to sell 0.2 lots.

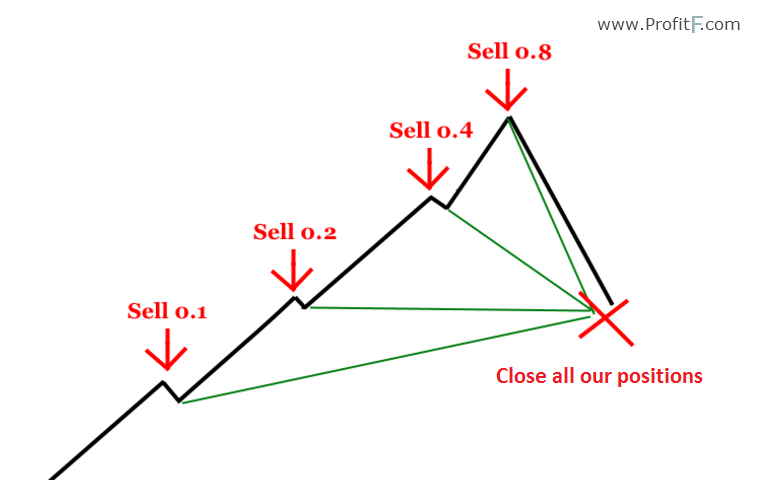

Now we begin waiting for the price to go downwards again:

Let’s imagine that the price doesn’t want to go lower and moves upwards again to conquer new market peaks.

Therefore, we open one more position to sell 0.4 lots, and so on.

If the price decides to reverse after all, we shall be able to close all our positions and break even or even get some profit:

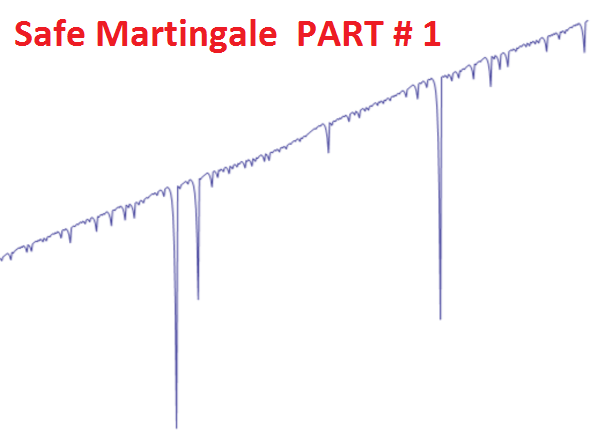

So, martingale creates an illusion that you can avoid making losing trades. But the problem is that a large lot size results in a huge risk. If we ride a long-sustained trend, we can lose our entire deposit.

This is the reason why the most of martingale-based trading systems lead to losses. Usage of the martingale has a lot of nuances, and it is particularly true for Expert Advisors.

It is worth noting that you can earn a fair amount of money, if you properly use these Expert Advisors.

Let’s look into different elements of the martingale, which you can implement in your trading strategy without using Expert Advisors and making elaborate calculations.

We shall try to use these single elements of this hazardous tactics and make it safe for our own benefit.

Before we start our discussion of the martingale’s elements, it is worth saying that you need an inherent profitable strategy. The strategy must be profitable and not include the elements of the martingale, otherwise it doesn’t work.

These mini-elements will help to enhance its profitability and reduce a moral load on a trader. However, it is impossible to do that without the inherent profitable strategy.

Besides, you need a high leverage. In principle, leverage of 1:100 will be quite enough, if you use the appropriate money management. The high leverage will not do harm to your trading, if you don’t abuse it, of course. Let’s assume that you have a profitable strategy and a high leverage. If so, let’s proceed to the next item.

(read more about Leverage in forex)

Let’s consider a commonly encountered mistake made by traders, whose strategy is based on the martingale approach.

The most of them think that the strategy implies trading without stop-losses. However, stop-losses can and must be used. By doing so, we can make ourselves safe from huge losses.

It is stupid and unsafe to trade without stop-losses

As soon as you have come across a profitable strategy, you need to backtest it for a number of losing trades made over the price history. It’s worth noting that the amount of consecutive losing trades is just what we are interested in. Besides, we need to find not the maximum, but the average amount of losing trades over the entire period of testing.

The time period, over which you should backtest your strategy, need to be selected individually. If your strategy implies trading on M5 timeframe, it is worth testing over the period of, at least, 1-2 months; if D1 timeframe, then, at least, a couple of years.

I’m sure that you’ll backtest your strategy properly and have no problems with it.

You can make use Forex Tester software to backtest your strategy.

Firstly, we must count the number of losing trades over the price history. Afterwards, we use a so-called “node”, i.e. orders that have an increased lot size, and which amount is equal to the number of losing trades.

Let’s assume that, on average, there are 3 consecutive losing trades under your strategy. Consequently, you should place 3 “nodes”.

Read more in Part #2