Commodity Channel Index indicator (CCI) – is an oscillator that measures the deviation of price from its statistical average prices. The CCI is an oscillator version of the reversion to the mean concept thus providing additional value. When combined with the Bollinger Bands or Envelopes indicator or any such indicators that work on the reversion to the mean method, the CCI oscillator can add value.

Although the name may be a bit misleading, the CCI indicator can be applied to any financial markets and not just confined to the commodity markets.

The CCI indicator is based on the “Typical price”, the HLC/3. The typical price is then converted to its 20 period simple moving average which is then subtracted from the current bar’s typical price. The result is then divided by 0.015.

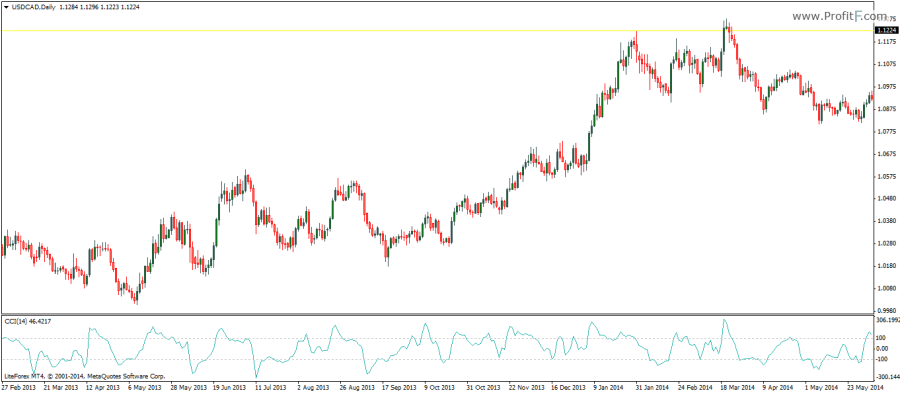

The CCI comes with a default setting of 14 periods and oscillators above and below the 0-line with 100 and -100 indicating overbought and oversold conditions in the market. Besides using the +100 and -100 levels, the CCI can also be used to spot divergences in the markets especially when they are in an established trend.

Other default values of the CCI indicator includes 7 and 21 periods based on which the CCI’s sensitivity can be changed.

Download Commodity Channel Index indicator

Add your review