Stop loss and take profit forms two important elements of trade management and is just as important as the analysis one would do before opening a position. In this article, we present a brief guide to using stop loss and take profits and also present a detailed tutorial into how to set the Stops and target levels using the MT4 trading platform.

Stop loss (SL) or stops is defined as an order that you tell or send to your broker telling them to limit the losses on an open position (or trade).

Take profit (TP) or target price is an order that you tell or send to your broker informing them to close your position or trade when price reaches a specified price level in profit. To learn more about these orders, read our article on Types of Orders in MetaTrader to learn in detail about the limit and stop orders. Stop loss and take profit levels are static in nature. In other words, the orders are triggered (and your trade is closed) when a security reaches a specified price level.

For example, if you placed a Buy order on EURUSD at 1.385 and set stop loss at 1.375 and target level of 1.395, when price moves below your entry and hits 1.375 your order is closed for a loss of 10 pips. Likewise, when price moves to 1.395, your order is closed for a profit of 10 pips.

Why set stop loss or target profit?

The reason why traders would set a stop loss or target profit levels is to manage their trades better. Imagine trading without a stop loss, which could potentially exhaust all your equity. Likewise, imagine not trading without a target price, which would basically expose your entire account equity to the market fluctuations.

What is Trailing Definition:

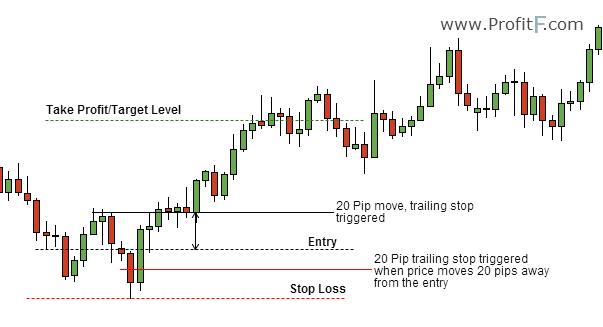

Trailing stops are more dynamic in nature. When using trailing stops the stop price level changes after a specified number of pips. Some trading platforms allow you to also set a trailing stop based on percentage moves as well. Trailing stops are usually used when you want to take as much of profits as possible during extreme trends. For example, setting a trailing stop of 20 Pips would mean that a new stop level would be set when price moves 20 pips in your favor.

For example, if you placed a Buy order on EURUSD at 1.385 and set the initial stop loss to 1.375 and a trailing stop of 10 Pips, then if price moves 20 pips in your favor the new stop loss would be moved to 1.385, thus making your trade break even. If price continues to move a further 20 pips, then the trailing stop moves another 10 pips in your favor setting your new stop loss order to 1.395 (thus locking in 10 pips of profit).

Trailing stops can be used alongside the take profit order as it can help to make your trade lock in as much pips as you want (and as specified by the trailing stop) instead of setting a static stop loss order.

The following chart below illustrates using stop loss, take profit and trailing stops.

How to set Stop Loss and Take Profit in MT4

On ECN account:

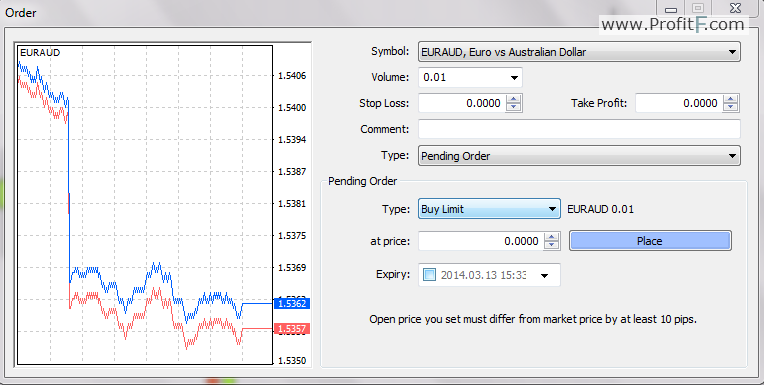

When you place a pending order, you can specify the entry, stop and target price levels. The following picture shows the order window when a pending order is used on the MT4 platform.

Figure 1: Stop and Target levels using pending orders

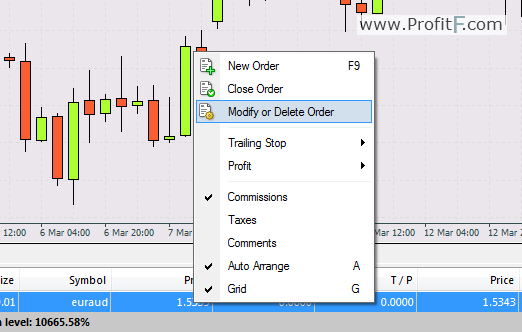

If you are using a market order, you can always update the stop and target levels by right clicking on the open position and selecting ‘Modify or Delete Order’ option, which opens the order management window allowing you to set up the stop and target levels.

Figure 2: Modifying Stop and Target Price in Market Order

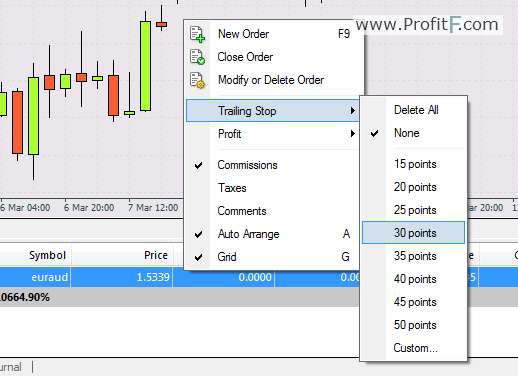

To set up trailing stops, right click on the open order and select ‘Trailing Stop’ In this option you can select a pre-defined trailing stop values or choose ‘Custom’ to set up your own trailing stop value. To delete previous trailing stop values, right click to select ‘Trailing Stop’ and then select ‘Delete All’ to remove the previous trailing stop value.

Figure 3: Setting up Trailing stops

Trailing stops, stop loss and take profit levels are one of the easiest trade management actions a trader can do. Despite their simplicity, using stop loss and take profit levels can help a trader to manage their profits and losses in a more efficient manner without having to expose their capital too much and risk losing it in its entirety.