Below is the outcome of last week’s high impact economic events;

| Event | Day | Expected | Outcome |

| US Consumer Confidence | Tuesday | 97 | 10.1 |

| Germany, Unemployment change | Wednesday | -5K | -7K |

| Italy, Unemployment data | Wednesday | 11.6% | 11.4% |

| Eurozone Consumer Price Index | Wednesday | 0.9% | 0.8% |

| US ADP Non-Farm Payrolls | Wednesday | 175K | 177K |

| Canada GDP | Wednesday | 0.4% | 0.6% |

| US Crude oil inventories | Wednesday | 0.921M | 2.276M |

| ChinaNon-Manufacturing PMI | Thursday | 53.5 | |

| UK Markit Manufacturing PMI | Thursday | 49 | 53.3 |

| US Initial jobless claims | Thursday | 265K | 263K |

| US ISM Manufacturing PMI | Thursday | 52 | 49.4 |

| US Non-Farm Payrolls | Friday | 180K | 151K |

Table; High impact economic events outcome (29th August – 02 September)

Fed Chair, Yellen stole the highlight for major FOMC (Federal Open Market Committee)’s members speechearlier at the Jackson Hole Symposium. A week later Non Farm Payroll report for August disappointed with a 151K figure versus the expected 181K figure. This caused a big reaction with the USD loosing against the majors. However; it quickly recovered as the figures revealed an increased probability for a rate hike during the September FOMC meeting. This was mainly attributed to Yellen’s speech alluding that any figure above 100K would be satisfactory;

“To simply provide jobs for those who are newly entering the labor force probably requires under 100,000 jobs per month,” Yellen.

The figure below shows the greenback recovering against the EUR following the NFP news impact loss last Friday;

Figure; 2ndSeptember Non-Farm Payroll Impact on EURUSD (15min Chart)

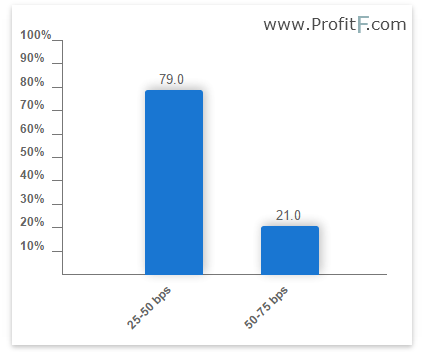

This strengthens the probability of a rate hike with the current probability for a rate hike this month standing at 79% for a 0.25-0.5 rate and 21% for a 0.5-075 rate as per the Fed watch tool by CME Group.

Figure; Rate hike probabilities (Data CME Group)

Last Week’s CFTC COT Report (30th August 2016);

| Currency | Net Commercial Positions (previous) | Net-Large Speculators Positions (previous) | Net-Small Speculative Positions (previous) |

| EURO | 100,808 (91,174) | -81,925 (-76,658) | -18,883 (-14,516) |

| AUS | -47,061 (-49,989) | 42,566 (42,757) | 4,495 (7,232) |

| GBP | 114,454 (114,580) | -92,485 (-94,978) | -21,969 (-19,602) |

| CAD | -34,035 (-31,617) | 22,400 (16,734) | 11,635 (14,883) |

| JPY | -57,204 (-56,237) | 66,661 (60,316) | -6,457 (-4,079) |

| CHF | 4,722 (1,051) | 8,208 (1,885) | -12,930 (-2,936) |

Table; COT Report for 30th August 2016 (Data CFTC)

The EURO large speculative net bearish positions increased from 76,658 to 81,925as the currency declined for the week. Bearish shorts has been decreasing for 5 consecutive weeks since July 26 which led to a bullish trend in the Euro. The decrease follows a bearish reversal pattern (dark cloud cover on the Euro futures daily charts).

Figure; Euro Analysis Based on COT Data (Chart courtesy of http://www.timingcharts.com/).

Another currency that showed increase in bearish positions is the AUS; however the increase was very slight. The GBP bearish positions decreased from 92, 485 to 94,978 with CAD, JPY, and the CHF all showing an increase in their long bets.

Summary

| Event | Date | Previous | Expected | Outcome |

| BOJ Governor Kuroda Speech | Monday, 02.30 GMT | |||

| UK Markit Services PMI | Monday, 08.30 GMT | 47.4 | 50 | 52.9 |

| Australia rate decision | Tuesday, 04.30 GMT | 1.5% | 1.5% | 1.5% |

| Switzerland GDP | Tuesday, 05.45 GMT | 1.1% | 0.9% | 2.0% |

| Eurozone GDP | Tuesday, 09.00 GMT | 0.3% | 0.3% | 0.3% |

| US Non- Manufacturing PMI | Tuesday, 15.00 GMT | 55.5 | 55 | 51.4 |

| FOMC Member Williams Speech | Wednesday, 01.45 GMT | |||

| Australia GDP | Wednesday, 01.30 GMT | 3.1% | 3.2% | |

| Canada interest rate decision | Wednesday, 14.00 GMT | 0.5% | 0.5% | |

| Japan GDP | Wednesday, 23.50 GMT | 974.4B | 2090B | |

| Australia Trade Balance | Thursday, 01.30 GMT | -3195M | -2750M | |

| ECB interest rate decision | Thursday, 11.45 GMT | 0% | 0% | |

| US Building permits | Thursday, 12.30 GMT | -5.5% | 3% | |

| US Initial jobless claims | Thursday, 12.30 GMT | 263K | 265K | |

| Switzerland Unemployment rate | Friday, 05.45 GMT | 3.3% | ||

| Canada Unemployment rate | Friday, 13.30 GMT | 6.9% | 6.9% |

Table; High impact economic events (5th – 9th September 2016)

Australia Gross Domestic Product:Wednesday, 01.30 GMT. The previous figure of 1.1% beat the previous estimates of 0.6% with a previous reading of 0.7% at the end of 2015. The expected reading is still 0.6%.

Canada rate decision: Wednesday, 14.00 GMT. Amidst improvement in the economy, the bench mark rate in Canada is expected to be held constant at 0.5% for the second consecutive time after two rate cuts this year.

ECB interest rate decision: Thursday, 11.45 GMT. Interests rates in the Eurozone are expected to remain at 0% until the Brexit decision reveals a slowing effect on the economy.

Initial Jobless Claims: Thursday, 12.30 GMT. The number of Americans filing for employment for the first time this week is expected to be 265K. The previous reading was 263K which was better than the expected figure of 265K. Building permits are expected to rise from -5.5% to 3%.

Canadian unemployment rate: Friday, 13.30 GMT. The rate of employment in Canada is expected to remain constant at 6.9%, however, the net change in employment is expected to rise to 3200 from a previous negative change of 31.2K.

You can view all the events scheduled this coming week in Economic Calendar

Subscribe to Newsletter “Overview of Major economic news next week”

(1 email/Week)