TABLE OF CONTENTS:

Forex Broker Exness (Review/Website) published news about new trading conditions for Cent, Mini and Classic accounts some days ago. The news refers to the fact that the Stop Out level is set to 0% now. As you know, the Stop Out level acts as a protective stop-loss and is calculated on the basis of the used margin. For example, 20% Stop Out means that all open positions will be closed, when the level of funds available on account drops below 20% of the margin amount (i.e. losses will exceed the account balance size less 20% of the margin).

What does it mean to hazardous Expert Advisors trading based on martingale and grid of orders? They have got more chances to wait out a drawdown / prolonged trend. (10 keys to successful trading by “hazardous” Forex robots)

But isn’t 0% Stop Out a usual advertising gimmick with a lot of terms written in the fine print? We studied the issue, tested it all in practice and arrived at verdict.

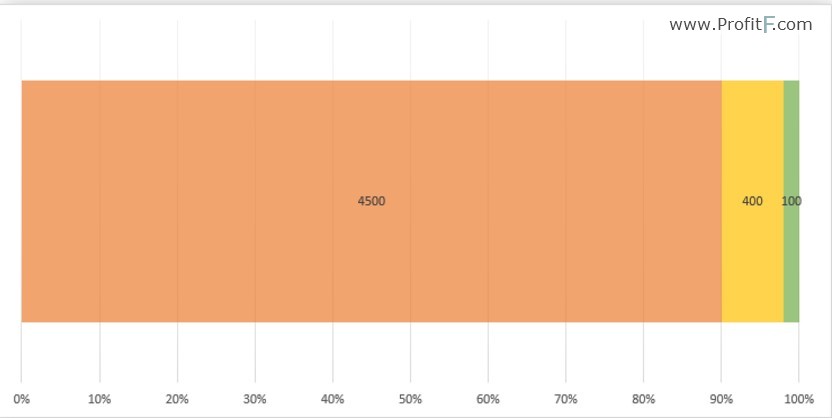

For example, you have $5,000 deposit, $500 of which are being used as collateral (margin). Therefore, all open positions will be closed, when your losses amount to $4,900 regardless of the fact that there are $100 yet available on the account. The given restriction is particularly essential in case of a heavy deposit load and usage of Forex strategies, which tend to have significant drawdowns. Besides, some brokers can set the Stop Out level to 50% and 100% that has a dramatic impact on the entire trading process.

Firstly, the Stop Out is used as a hedging by forex brokers. It is some kind of a protective buffer, which doesn’t allow you to lose more than your account balance. 0% Stop Out means that a trader may invest absolutely all the funds that he/she deposited into personal account with no danger of forced closure of positions. In other words, losses will grow, until the last cent is available on the account, and then open positions will be forcibly closed by the Stop Out anyhow.

On the one hand, the Stop Out can be used as a protective measure not allowing a trader to lose his/her deposit entirely. In some cases it can be a reasonable measure, although at the same time it is another restrictive measure of risk management, since you will always have to worry about the fact that your losses will not drop below the allowable level.

0% Stop Out level is the most actual for the strategies that tend to have significant drawdowns. The account, where the Stop Out level is set to 0%, is perfect for grid-based Forex Robots and strategies based on martingale; it enables them to use all the capacities of deposit. Every extra cent may be crucial for hazardous strategies, and the additional measures, like Stop Out level, just get in the way.

The Stop Out level may be also suitable for hedging and arbitrage strategies, since it makes the process of risk management more flexible. It’s up to you to decide, when it makes sense to close positions or use your deposit in its full capacity. In any case 0% Stop Out doesn’t serve the interests of a broker, since it will incur losses in case of compulsory closure of positions. This is why we are going to test the function in practice now.

Let’s open a EXNESS cent account and make a deposit of 300 cents. Our task is to lose the entire deposit and thereby verify the information contained in the company’s press release.

To do it, we need to open a position of 3 lots by placing 3 orders allowing for leverage of 1:1000 and the maximum lot per trade, which is 1 lot. In this case the margin amounts to more than half of the funds in the deposit. Given the high leverage the price will move by less than 10 points, before all the capacities of the deposit are exhausted.

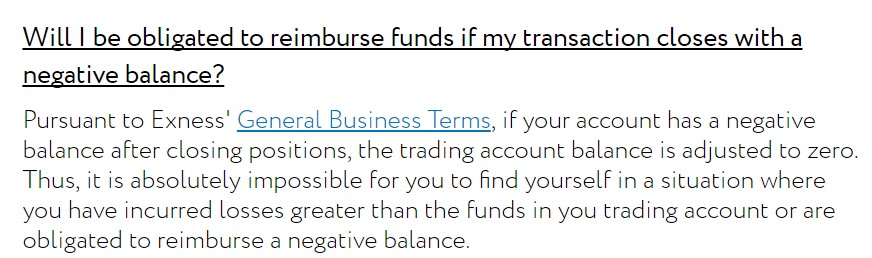

The important thing is that no matter how fast the system closes positions automatically, they might be closed at loss at any time in case of a low Stop Out level. It occurs in case of a fast quotes flow, when a position has no time to be closed at the required price and a slippage happens, i.e. the position is closed inside a price gap. If it happens, a broker may require you to indemnify for any losses incurred after all trades have been closed.

What does Exness say about it? The company states in its press release that you shouldn’t worry about a negative account balance, since your losses will be recovered and your account balance will be adjusted to zero in any case.

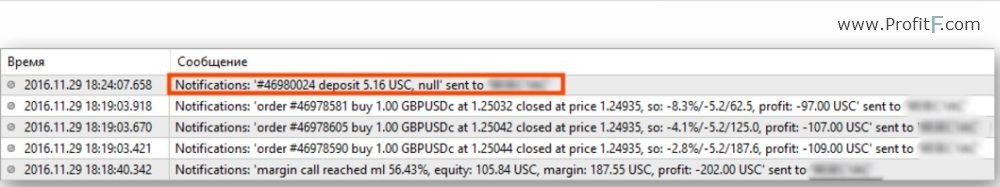

In fact, it did happen as it said. The account balance was adjusted to zero about several minutes after closure of all positions, and a message telling you that 5.16 cents of compensation had been credited to your account appeared in Account History and Journal Tabs.

Nowadays Exness broker is actually one of the best solutions for high-risk strategies. High leverage and 0% Stop Out level enable you to fine-tune risks and give you a freedom to decide, when it makes sense to close positions or trade “at full throttle”. The crucial point is that the broker guarantees that it will adjust your account balance to zero, if you have lost more than your initial investments. In other words, however poor the market conditions are, you can always expect that the exact amount of initially deposited funds lost as the result of these conditions will be recovered

Add your review