Introduction to the Carry Trade Strategy

The carry trade strategy is one of the well known and a widely used trading strategy. It is based upon the fundamental basis of interest rate differentials and is mostly used by institutional investors. While carry trade strategy has been an area of interest for retail traders, it is not a high yielding or a profitable trading strategy unless there is a technical correlation that goes within the same direction of the carry trade strategy. In this article, you will learn about the basics of carry trade strategy and how it is used. Carry trade strategy works for institutional investors as they can borrow money from a lower interest rate currency to fund the stock markets of the higher interest rate offering country.

Interest Rate Differentials

Interest rate differential is nothing but the difference of interest between one currency to another. The interest rates for a currency are set by the country’s respective central banks. Therefore obvious from this, when there is a positive interest rate differential in a currency pair, long positions are taken.

The basis of carry trade is formed upon the central bank’s monetary policies, which are released every month. Investors look for clues for any signs of potential changes to interest rates, be it an interest rate hike or an interest rate cut which affects the carry trade.

The table below shows the current interest rates of key central banks from the major currency pairs.

| Country | Currency | Central Bank | Interest Rate |

| New Zealand | NZD | RBNZ | 3.5% |

| Australia | AUD | RBA | 2.5% |

| Canada | CAD | BOC | 1% |

| UK | GBP | BoE | 0.5% |

| US | USD | Federal Reserve | 0.25% |

| Eurozone | EUR | ECB | 0.15% |

| Japan | JPY | BoJ | 0.1% |

| Switzerland | CHF | SNB | 0% |

Based on the above table, it is ideal to take long positions at the CHF or Swiss Franc or the Yen or the Euro. Buying the Kiwi Dollar and selling the Swiss Franc or the Euro or the Yen would result in a positive interest rate differential. Therefore, investors buy up currencies of higher interest rates to either fund other investments or to hold on until the accumulated interest is significant.

Stock Markets Correlation with Carry Trade

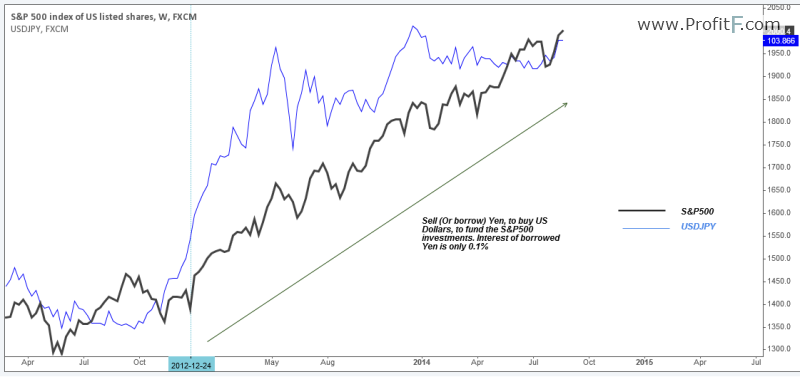

The stock markets of major economies usually move within a high correlation to carry trade. For example, among the US investors, the Japanese Yen offers the lowest interest. Therefore, traders tend to buy the Yen, selling their home currency (the USD in this example) to fund their respective stock markets. The chart below shows how the S&P500 shows a strong correlation to the USDJPY long positions.

The above chart shows the correlation between the USDJPY currency pair and the S&P500 stock index. By taking advantage of the carry trade, investors borrow the Yen, to sell it for US Dollars which is then used to fund the US stock markets. When the investment objective is achieved, investors return the Japanese Yen at 0.1% interest making themselves a healthy profit.

To understand the power of carry trade, imagine investors having to borrow US dollars from US banks to fund their stock market investments. In this case, investors will have to pay an interest of 0.25%.

Carry Trade & Forex Trading

Although carry trade cannot be a highly profitable trading strategy in forex, it does help in a way. Traders who hold overnight open positions are charged a swap or a rollover. This rollover charges are determined by the currency pair’s respective interest rates. The table below shows a brief overview of how the interest rates can affect some currency pairs positions.

| Currency Pair | Currency A Interest Rate | Currency B Interest Rate | Long Position Swaps | Short Position Swaps |

| AUDUSD | 2.5% | 0.25% | +ve | -ve |

| AUDJPY | 2.5% | 0.1% | +ve | -ve |

| NZDUSD | 3.5% | 0.15% | +ve | -ve |

| EURCAD | 0.15% | 1% | -ve | +ve |

| GBPNZD | 0.5% | 3.5% | -ve | +ve |

| EURAUD | 0.15% | 2.5% | -ve | +ve |

From the above table, forex traders, especially swing traders can trade accordingly in order to maximize their profits. For example, traders who are used to keeping a position open over weeks should ideally look for trading currency pairs that offer positive overnight swaps. The positive interest rate differentials allow traders to make additional profits which when kept open over a considerable period of time can easily make up for any trading commissions and other fees that traders are usually charged.

To conclude, carry trade strategy is primarily an institutional investor strategy that goes with the Buy and hold investment method. A lower yielding currency is borrowed to fund investments of a higher yielding currency. Additionally, investors would buy up higher yielding currency in order to earn the higher interest rates.

A note of caution about carry trade and the interest rate differentials is that most emerging markets tend to offer higher interest rates in order to attract foreign institutional investment. For example, countries like Russia, South Africa, India have interest rates of 8%, 5.75%, 8% respectively. Although these emerging markets offer higher interest rates, they are very volatile and change more frequently than developed economies.

Add your review