While Binary options traditionally started out with the plain CALL/PUT options over time the different binary options contracts have evolved giving rise to different type of Binary options. The wide choice offered caters to different types of trader profiles and risk sentiment. Understanding the different types of binary options is essential for a trader before they blindly start trading one of the many types of options that are available. In this article, we explain the different kinds of option expiries in an effort to educate the reader about the same.

Types of Binary Options trades

Binary options can be broadly classified into the following types:

High/Low Binary Options

The traditional CALL/PUT option, trading High Low option is as simple as speculating if the price of an instrument will close above the price at which the contract was entered or if the price will close lower than the strike price. CALL/PUT options are one of the easiest of binary options to trade. They typically offer a return of 60 – 75% of the invested amount and there is a wide choice of expiry date and times to choose from.

Touch Binary Options

Touch options are further categorized into the following two types:

The picture above shows a Touch Option being purchased. The trader expects EURUSD to touch 1.38786 by the time the option expires. If the target price is not achieved, the trader loses their invested amount and if it does, they stand to gain 175%.

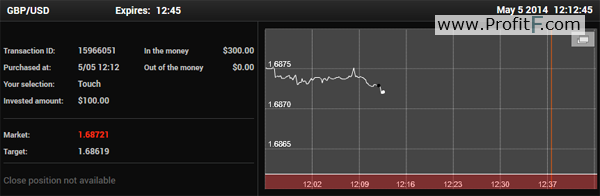

The picture above shows an example of a GBPUSD High Yield Option. The trader placed a No touch option, meaning that GBPUSD is not expected to hit 1.68619 by 12:45 the option expiry time. If the trade is successful, the high yield touch option gives a whopping 300% return on investment while still keeping the investment risk capped to the amount invested.

Boundary Binary Options

With this type of option a trader can speculate if the price of the instrument will close within a range or within the boundary. The boundary option has three prices. Upper, Market and Lower and traders can place an IN or an OUT option. IN option specifies that the instrument will close within the upper range of the instrument and an OUT option specifies that the instrument will close in the lower range of the boundary.

The above picture shows a Boundary option with an expiry time of 11:30. So when a trader selects an IN option, they expect EURUSD to close within the boundary of 1.38754 and 1.38775. If an OUT option is selected, then the trader would expect EURUSD to close within 1.38754 and 1.38733.If the option fails to achieve its objective, the option is deemed to expire out of the money.

The returns available for Boundary option varies from one broker to another. (See Best Binary Options Brokers in our ProfitF table)

Short Term Binary Options

The short term option expiries are very fast paced and are not for the light of heart. It is possible to quickly lose all of your investment as it is very addictive but fun at the same time. Short term options come with a 30sec, 60sec, 2minutes and 15minutes expiry times. With short term options a trader speculates if price of the instrument will closer higher or lower than the market price at the time the contract expires. These are actually similar to high/low options but have a very short term expiry dates.

The different types of binary options offer different returns but the risk is always capped to the amount you wish to invest. There are many ways the above types of options can be traded depending on a trader’s risk profile and most importantly their trading strategy.

Add your review