Mass index indicator was developed by Donald Dorsey and is used for identifying turns in the trend. This is done by measuring the range or the distance between the high and low prices. As the range beings to get wider, the Mass Index grows in value and declines when the range between the prices starts to fall.

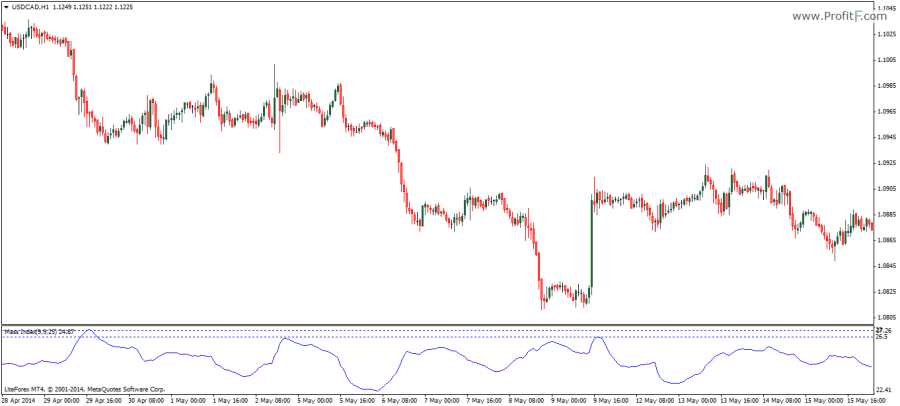

Dorsey claimed that the mass index signal was designed on a different model, calling it the ‘reversal bulge‘. This phenomenon is formed when a 25 period mass index first rises above the oscillator’s value of 27 and then drops below the value of 26.5.

Not to be misunderstood as a directional move of the trend, when the mass index turns around from 27 and 26.5 it can signal a turn in the trend regardless of it being an uptrend or a downtrend. The Mass index is defaulted to a look back period of 25 and is calculated as the sum of the 25 period values or the look back period for the 9-period EMA of the 9 period EMA of the high and low.

The Mass index is ideal when being used long with other trend indicators such as the moving average indicator.