SimpleStoch – Stochastics oscillator based trading strategy is one of the simplest oscillator based trading strategy. It relies purely on the overbought and oversold levels of the oscillator. The trading strategy works as a quick scalping based trading system and works in almost any chart time frame.

Strategy Set up

Recommended Broker >>

SimpleStoch Strategy Rules

Long Set up:

- Stochastics gives a bullish crossover and rises from below 20

- Buy on candle close

- Take profit 50 – 80 pips

- Stop loss below the most recent low

Short Set up:

- Stochastics oscillator gives a bearish crossover and falls from above 80

- Sell on candle close

- Take profit 50 – 80 pips

- Stop loss below the most recent high

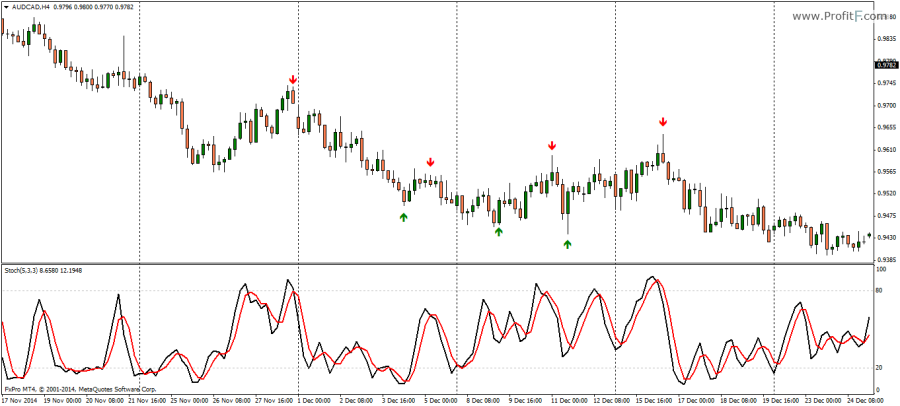

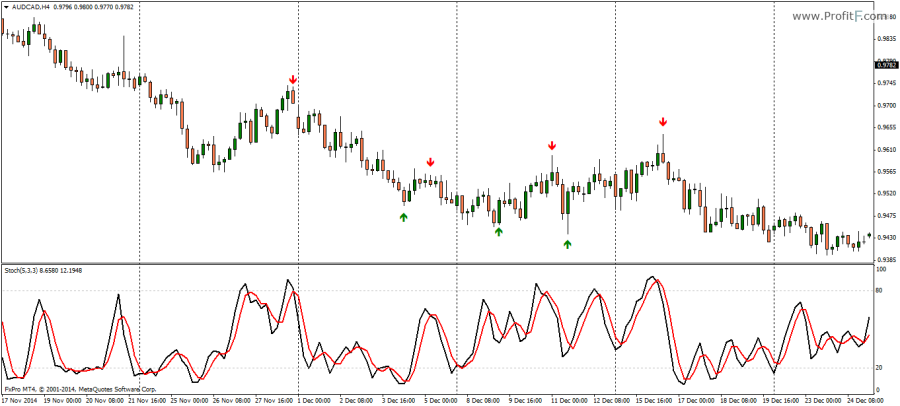

Strategy Examples

- The above chart shows multiple buy/sell signals using the Stochastics oscillator

- Starting from the left, after the Stochs close below 80 with a bearish cross over, a sell order is placed on candle close with stops at the high of the previous candlestick

- Take profit is placed 50 – 80 pips from entry, resulting in a profit

- The next signal we get is a buy signal as stochastics oscillator gives a bullish cross over and rises above 20.

- A buy order is placed on candle close with stops at the low of the previous candlestick

- Take profit is set to 50 – 80 pips from entry, resulting in a profit

Conclusion

SimpleStoch forex System is very simple and ideal for scalping the markets. With enough practice traders can make use of this trading strategy to make quick profits in the markets. The main factor to the success of this trading strategy is that entries (buy or sell) are to be taken only after the candle closes while also bearing in mind the spread when placing the take profit and stop loss levels.

Add your review