TABLE OF CONTENTS:

Currency correlation is one of the most common phenomena in the currency markets. It is also undoubtedly an area of interest among traders who want to take their trading to the next level. While complex, at the very core, currency correlation is probably one of the simplest of all to understand.

Correlation is a term which is used to depict when two currency pairs in the context of forex trading tend to exhibit the same characteristics. This could mean; two currency pairs could rally in unison or decline together. One of the most common ways to trade the forex markets is to look at a currency pair in isolation. While there is nothing wrong in this approach, applying the concept of correlation in the right way can magnify the profits (and losses). The term correlation is a statistical term and is measured within the range of +1 and -1. A currency pair with +1 correlation (or positive correlation) often moves in tandem, while a currency pair with -1 correlation (or negative correlation) tends to move in the opposite direction. However, it is unlikely to find such a tightly correlated currency pair. The usually accepted values for correlation are from +0.7 (or 70% correlation) and -0.7 (or -70% correlation).

Currency correlations occur all the time due to the basic fact that currencies are traded in pairs in the spot forex market. For example, when you trade EURUSD, you would either buy the Euro and sell the US Dollar or vice versa. At regular intervals, some currency pairs tend to correlate based on the larger market dynamics such as supply and demand. Taking a very simple example of a central bank hiking interest rates in a surprise move (and one where the expectations were for no rate hikes), that particular currency would often rally across its peers. Therefore, if the RBA for example had hike rates, then all AUD crosses would be rallying where the Australian Dollar is the bid currency (and all AUD crosses would decline where the Australian Dollar is the quote currency).

Besides these short term correlations, currencies tend to exhibit positive or negative correlations which can be spread across inter markets (ex: Forex and Commodities) or within the markets (ex: USDCHF and EURUSD).

For a trader who understands currency correlations, the most simplest and important of all points to bear in mind is not to have exposure in the same direction on two currency pairs that are negatively correlated.

For example, EURUSD and USDCHF are two of the most common negatively correlated currency pairs. This means, if you are long on EURUSD, you would not go long on USDCHF or vice versa. Depending on the time frame you are trading, currency correlations can be an important aspect. The chart below shows EURAUD and AUDCAD which have -8 (or -80%) correlation.

EURAUD & AUDCAD: Negative Correlation

The above chart shows how prices in EURAUD and AUDCAD have been moving in opposite directions based on the correlation. Therefore, by learning the simple fact that these two currencies are negatively correlated, a trader can be more careful by going long on both the currency pairs.

Look at Currency Correlation Table here

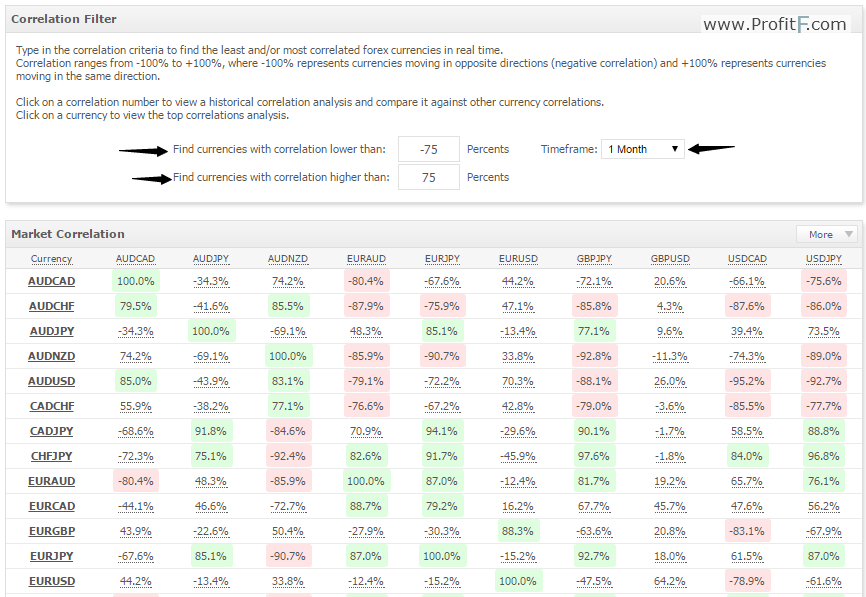

1 month currency correlation chart

The above chart is used by setting the filter to +75% (positive correlation) and -75% (negative correlation). The chart can be useful in showing traders which pairs move similarly and which pairs are moving in opposite direction. As an example, if you were to go long on AUDCAD, then EURAUD and USDJPY short positions would offer greater potential to maximize your profits or vice versa. Likewise, if you were long on AUDCHF, then you could also look at long positions in AUDZND as well.

Traders should however note that currency correlation doesn’t mean prices behave in similar or opposite directions to the pips. Some currency pairs might move more in tandem while other currency pairs might lag. It is therefore essential that a trader apply their trading strategies to the correlated pairs and take a trading decision accordingly. Also, correlations tend to change over a period of time which is another factor to bear in mind. These correlation changes can happen due to many reasons such as market events, interest rate decisions, and geo-political shifts among other things. Therefore, correlations are dynamic and a trader needs to keep this in mind.

Add your review