TABLE OF CONTENTS:

Trading the financial markets can be as exciting as it is rewarding. Markets are constantly fluctuating: no two days are ever the same. It is really hard to get rid of the trading bug once you have been bitten! While a passion for trading is great to get you over those hurdles when you first start out, the other extreme of loving trading too much can also wreak havoc on your trading account. Yes, there is a downside of loving trading too much. Here are three main symptoms and how to overcome them.

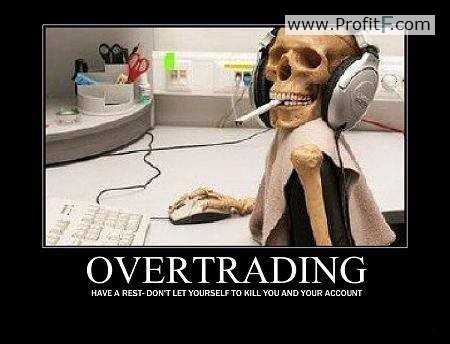

When you love something, there is a tendency to want to have as much of it as possible. The satisfaction of figuring something out and getting a winning trade is addictive and many will try to replicate that rush over and over. While being motivated to learn as much as possible is a good thing, there is a fine line between that and over-trading. Sometimes an excessive desire to get amongst the action can cause traders to take less than optimal set ups. It can be hard to be impartial. Even the most disciplined trader can be subconsciously swayed by his or her emotions. It is all about being in control emotionally and being able to recognise when you may be letting your optimism get the better of you. This is not easy to do, and requires awareness and practice.

Another telling sign that you may be getting too caught up in trading is an inability to have a life outside of it. If you find yourself only buying books about trading, only watching the financial channel or only socialising with people who trade then you know you have a problem. While some professional traders seem to live and breathe the markets, it is important to remember that the media only gives a one-side portrayal of these people. Life is all about balance. Your trading career will not be sustainable if you do not also pay attention to your health, your family and the world around you. Again, there is a fine line between being focused and having tunnel vision. The latter is destructive and whatever results you get will most likely come from having sacrificed other vital areas of your life.

Building a career in trading is very much like building a career in any other industry. Successful traders are in it for the long-run and it is very much like running a marathon. At every point in your career, there will be decisions you need to make that weigh up the short term costs against the potential long term benefit. The idea is to pace yourself and make appropriate concessions to avoid burning out before you achieve your goals. Traders who are unable to accurately assess and monitor their own progress tend to bite off more than they can chew and end up scrambling. For example, they may use more leverage than is reasonable or choose to trade markets which they know little about. If you are not interested in a particular market or a particular style of trading then why force yourself to trade like that? Trying to do everything will only result in poor application of your trading strategy that wears you (and your enthusiasm) down over time.

There are many different ways to manage your passion for trading and to keep your emotions in check. We refer to these as “circuit breakers”. If you ever find yourself losing a disproportionate number of trades then it certainly can help to step away and take a break from trading. Reassess your strategy and check if you have missed something. Are you being too optimistic and care-free in your assessment of your strategy factors? Are you trying to trade when you are tired, causing you to lack focus and objectivity? That point where you step back and take a break varies for everyone and it is important to know when to give yourself a rest.

Add your review