TABLE OF CONTENTS:

Psychological Levels: Why do they work and how to trade them

Trading support and resistance can be a fantastic way to approach the market and for many new traders this is one of the first areas of technical analysis that they come to properly understand. There are a great many varieties of support and resistance in the market that traders can look to build strategies around such as: key highs/lows, trend lines, Fibonacci levels, moving averages, pivots, Bollinger bands and more. However, there are also levels that are already embedded within the market that can act as powerful support and resistance and traders don’t need any tools or to perform any complicated analysis to find them. These levels are called “Psychological levels”

Psychological levels are price levels which tend to draw big market attention and typically witness a reaction by price when tested. These levels are the main round numbers (whole numbers), referred to as “Double Zeros such as .9800, .990.

The image above shows a chart of USDJPY and the white lines highlight each double zero level from 100 – 104. Look just how many times these levels act as either support or resistance causing a reaction in price. These types of reaction are extremely common at these levels and you can see just how many reversals occurred at these levels.

So what is driving the behaviour of price when it interacts with these levels and why are they so important?

The main thinking as to why these levels are so important is simply to do with human nature and our general tendency for order, simplicity and reference. (Read more about psychology in Trading here >>) These whole number price levels are often used by traders due to their simplicity. If a trader is looking to sell GBPUSD around 1.5780 they are likely to round up and put the order at 1.58. Alternatively, if they do sell GBPUSD around 1.5780, their stop is very likely to be placed at 1.60. This is simply down to a natural tendency to round numbers up to provide an easier reference point.

Similarly, round numbers are very often used as profit targets. If a trader is long from around 1.5730 in GBPUSD they are very likely to target a move into 1.58 or 1.59, again simply due to the ease of rounding to the nearest whole number instead of dealing with an awkward part number such as 1.5794.

These psychological levels also come into play because of the big institutional and corporate interest that they attract. Many central banks have price reference ranges for their currencies which they like to see price trading in and very often when price moves to the upper or lower end of these reference ranges, we tend to see intervention by central banks, either verbal or actual. (read more about Central Banks )

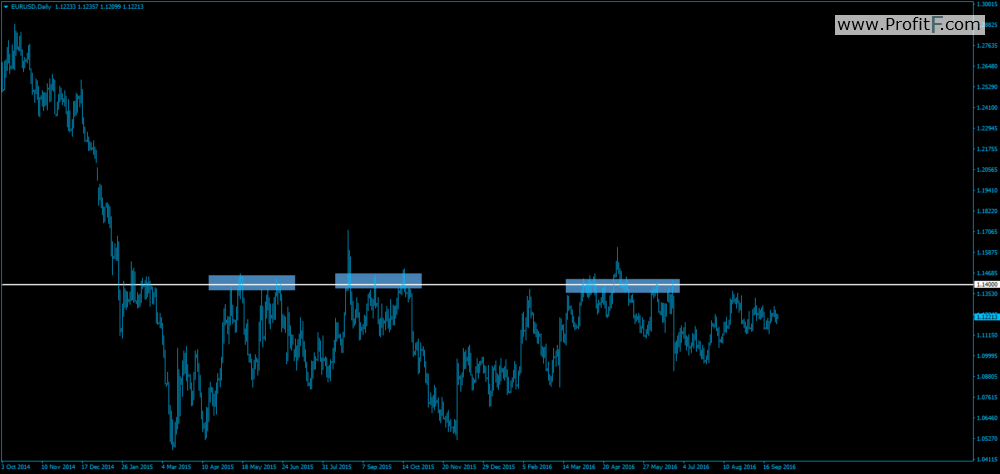

In the image above you can see EURUSD since late 2014. Look how many times the 1.14 level yielded a reversal in price over the last two years. Price made several attempts at that level and even though on occasion it ran higher slightly, each time price reversed lower. This was clearly a key psychological level for the ECB as typically each time price traded to that level we start hearing Dovish comments from the ECB who sought to talk the currency down.

Similarly, corporates and financial institutions have a tendency to execute at whole numbers which again increases the importance of these levels and strengthens the price reactions we tend to see.

It is important to note that these levels don’t always yield a reaction. As we saw on the first image there are plenty of times when price simply moves straight through them, however, these reactions are definitely common enough to warrant attention being paid to them. Typically, these key Psychological levels yield the strongest reactions when tested for the first time after a long period of being untested.

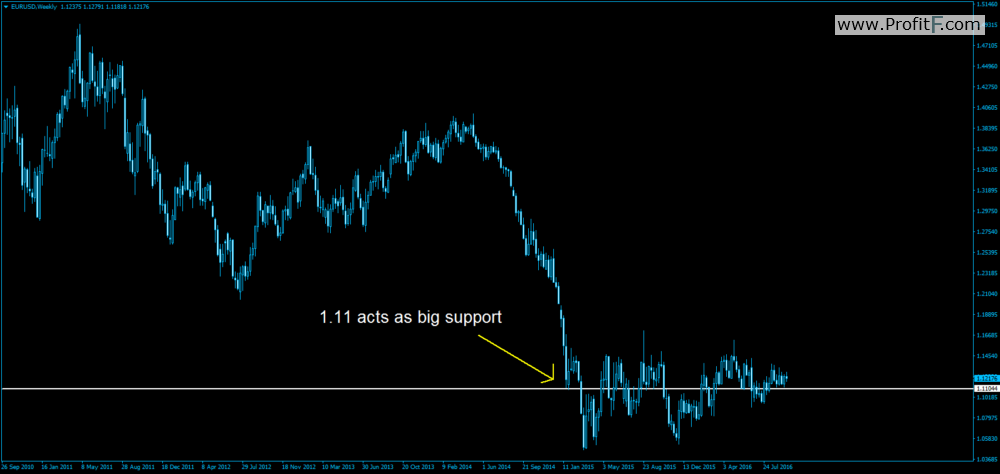

The image above shows EURUSD over the last five years. Whilst price moved almost in a straight line over the massive decline which occurred from summer 2014 you can see that as price tested the 1.11 level for the first time it found huge support there bouncing over 400 pips higher.

There are several ways that these levels can be of use to traders. Many Forex traders look to initiated trades at these level, fading price as it trades into key “double zero” levels. Typically, this strategy works best if you look to identify confluence between these levels and other technical elements such as traditional support and resistance, trend lines or key Fibonacci levels for example. Looking to fade price as it trades into a key psychological level where there is confluence with another key technical element can be a really great way to find entry points to key market reversals.

In the image above you can see a great example of how to identify confluence between a key Psychological level and other technical elements. The 1.16 level in EURUSD lined up perfectly with the trend line resistance of a bullish channel structure as well as the 1.27% Fibonacci extension of the initial move. The presence of a Psychological level alongside these two key technical elements strengthens the likelihood of price reversing from the level and is a great place to test the market.

Similarly, these are important levels to be aware of for trade management purposes. When placing stops, try to give you self some room around whole numbers so that you don’t get stopped out before price reverses. These levels also need to be considered when setting profit targets. For example, let’s say you enter a short trade in EURUSD at 1.0980 and risk 100 pips and are aiming for 3:1 return which gives you a profit target of 1.0680, you would likely be better off taking profit at 1.07 as there is a risk that price will bounce from this key psychological level.

Useful Psychological levels can be in helping you find entry points to the market as well as managing your trades. Like all trading systems or methods, the approach is not 100% effective but when combined with other factors it can certainly be a useful addition to your trading plan and is worth spending some time researching on your charts.