TABLE OF CONTENTS:

Read previous part “Safe martingale and manual trading (Part 1)” here>>

Imagine that your strategy implies 10 points stop-loss and 20 points take-profit. You have find out that the average number of losing trades in one series made under your strategy equals 3.

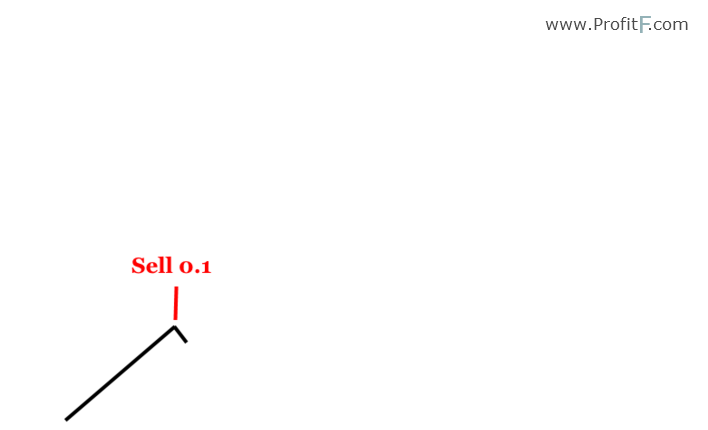

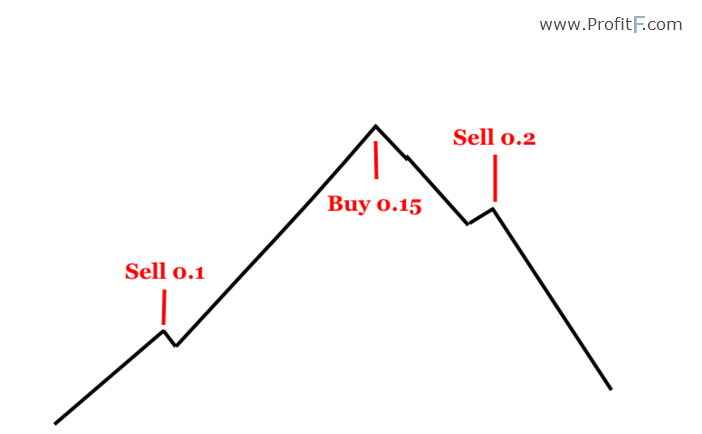

The price moves in some direction on the chart, and you have decided to sell 0.1 lots:

TP = 20, SL=10

The price has gone upwards, and a stop-loss has triggered. You have got a loss of 10 points.

The price goes further to some place, and you have got a Sell signal again.

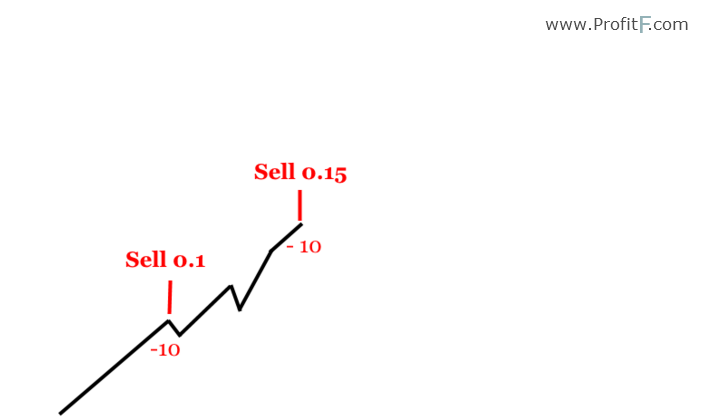

You make a Sell trade again, but its lot size has increased now.

At the moment I’m going to examine one issue commonly encountered among traders in more details. They often ask: “How many times do I need to increase the lot size by?”

It is for some reason believed that the lot size should be always doubled, if the martingale is used. That is not necessarily so. You can multiply the lot size by 2, 3 times or by 30%. It all depends on your desire and appetite for risk only.

In our case let’s increase the lot size by 50%:

TP = 20, SL=10

We have sold 0.15 lots, and our system has failed again. We have got a loss of 10 points once again.

The price fluctuates somehow on the chart again, a Sell signal is generated.

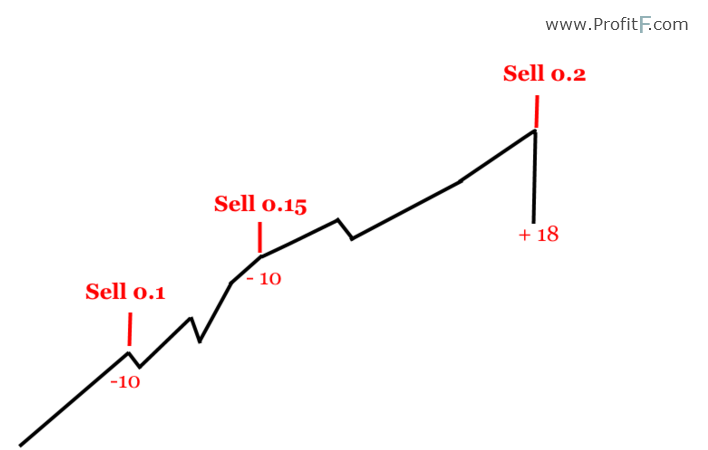

After we have noticed it, we place an order with the lot size increased by 50%:

Indeed, the price goes in our direction, and we take profit of 20 points.

Now let’s calculate, what would happen, if we haven’t increased the lot size, but trade 0.1 lots all the time.

For the first time, we have lost $10. For the second time, we have lost $10 (the lot size is the same). For the third time, we have taken profit. Since the lot size is the same, we have taken $20 profit.

As a result, we have broken even. It is good news, since we haven’t incurred losses.

Now let’s calculate, how much we would earn, if we have increased the lot size by 50%. For the first time, we would lose $10. For the second time, we would lose $15. For the third time, we would take $40 profit.

As a result, we would take net profit of $15 instead of $0, if the lot size remains the same.

What should we do, if the third trade brings us losses, and the price keeps going up?

Assuming that the price starts going further, and a signal occurs again. We begin to sell once again. What lot size should be used at that?

We have found out by means of the backtesting that the average number of consecutive losing trades allowed by our strategy is three. It follows that we can increase our position size by three times. The fourth losing trade is considered to be a non-standard case.

If we make four consecutive losing trades, it doesn’t make sense to run the risk. It would be better to smoothly decrease the lot size up to 0.15 lots or set up our initial 0.1 lots immediately to begin trading with our standard lot size, before the strategy enters its usual mode of losing and profitable trades.

Martingale buy-sell example

Traders got used to regard martingale as a trading in one direction only. Truly speaking, you shouldn’t do that.

Imagine that you have a losing Sell trade.

The price goes against you. A stop-loss is triggered, and then a Buy signal occurs. Why not to catch the signal?

We open a Buy order, but we increase its lot size up to 0.15 lots. Let’s assume that the price goes against us once again and breaks an important level: We open a Sell trade of 0.2 lots, and then we take profit: If our strategy has five consecutive losing trades over the price history, then we would use 5 “nodes”.

The maximum lot mustn’t exceed 10% of your deposit.

Martingale and money management. You shouldn’t’ forget about money management, when you trade. The maximum lot for your series of orders mustn’t exceed 10% of your deposit. It is necessary in case a stop-loss of the last order of your series is triggered.

Of course, we increase our risks a little. However, at that we adhere to prudence, since our task is to earn profit, but not to lose our deposit.

Open a trade manually and then run an Expert Advisor

One of the methods of implementation of this strategy is to make use of technical assistance in the course of your trading. For example, you can identify entry points and open positions manually and then launch an Expert Advisor, which automatically opens additional positions that have an increased lot size.

However, the method has a disadvantage. This approach will not allow you using signals generated by your strategy: the lot size will be increased, and additional orders will be opened at a certain distance from your first entry only.

Use “nodes” at support/resistance levels

It would be a good idea to open positions, which have an increased lot size, at the levels of support-resistance.

You can open additional orders at these levels, even if the signals generated by your strategy don’t occur there.

Assuming that we make a buy here:

The price doesn’t hit our profit target, reverses and triggers a stop-loss.

Where can we place an additional order?

In case of a negative market scenario we can place the order at the 1.08 round number level:

As you might have noticed, the price has already bounced off the level.

Our order becomes losing, and the additional order triggers and then yields us profit.

We should enter the market on the resistance levels or any other important levels in the same way.

I guess you understand that you should test your strategy in full over the price history before you start trading on a real or demo account.

It can help you backtest your strategy and also not to lose your money on your deposit.

I hope that these tips will help you in your trading.

I would like to remind you that these elements can be implemented, if only you have a profitable strategy. Be careful and don’t forget about money management.

(see our free forex strategies here >, Not free forex systems here >)

Add your review