Elliott Wave Theory. principle, patterns, analysis. Elliott wave trading method

1. About Ralph Nelson Elliott

2. Basic of The Elliott Wave Theory

3. Motive Waves

3.1 Ideal Impulse Wave

3. 2. Three main rules for impulse waves

4. Corrective Waves 5. Principle of alternation in Elliott Waves

5. Principle of alternation

6. “Elliott Waves” – Psychology

7. Conclusion

1. About Ralph Nelson Elliott

Ralph Nelson Elliott was born in Marysville, Kansas on July 28th 1871. During the greater part of his life he worked as an accountant for several railroad companies in Central America and Mexico. Elliott was forced to retire early, due to debilitating intestinal illness he cought during his time in Central America. In order to keep his mind occupied, Elliott began studying the American stock market. Somewhere in the mid 1930s he discovered, that the price action of stocks is not random or chaotic, but patterned. The Market is governed by natural laws, contrary to the widely-accepted opinion that news and events are the driving force behind price trends.

In 1946 Elliott published a book called “Nature’s Law – The Secret of the Universe”, where he explained everything he had discovered. In this book he stressed out, that the Wave Principle is applicable not only to the markets, but in many other fields of life. Elliott died on January 15th 1948, but his legacy is still alive, thanks to people like Charles Collins, A.J.Frost and Robert Precher Jr.

2. Basic of The Elliott Wave Theory

But what exactly is The Elliott Wave Principle and how we can apply it to financial markets in real time?

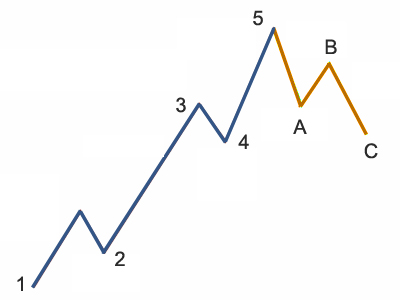

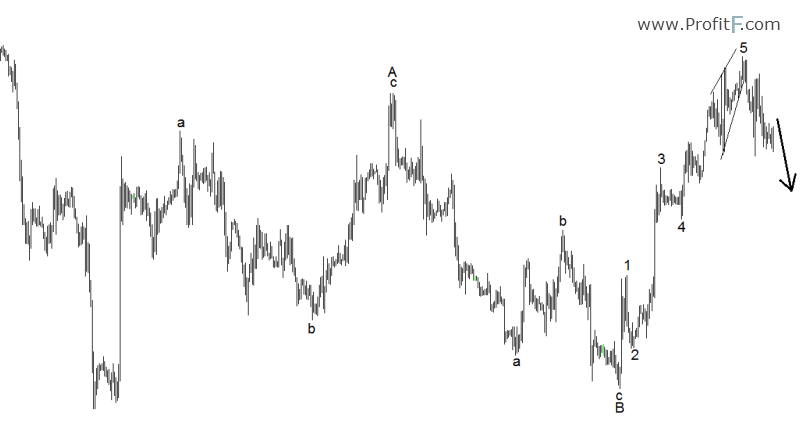

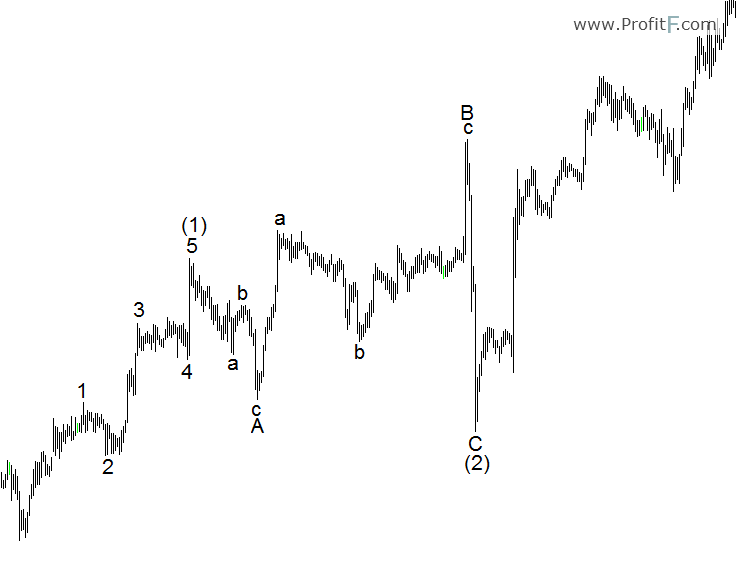

Elliott Wave 5-3 cycle

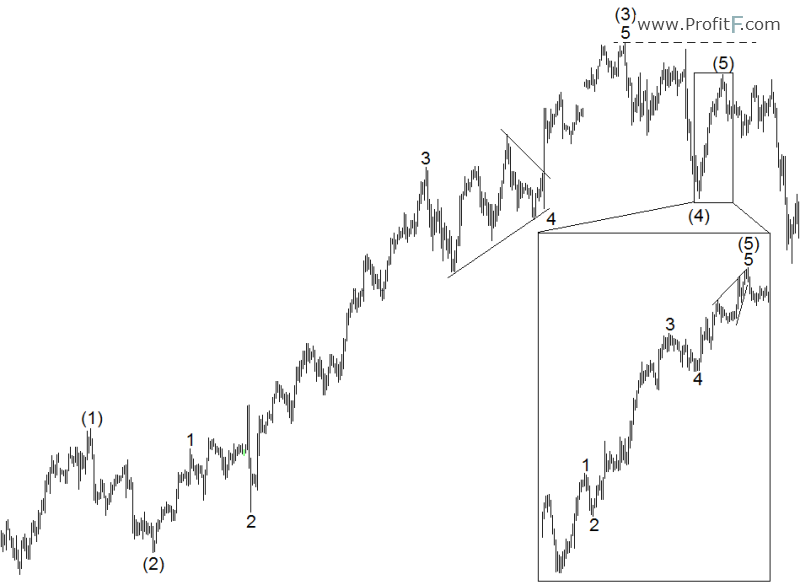

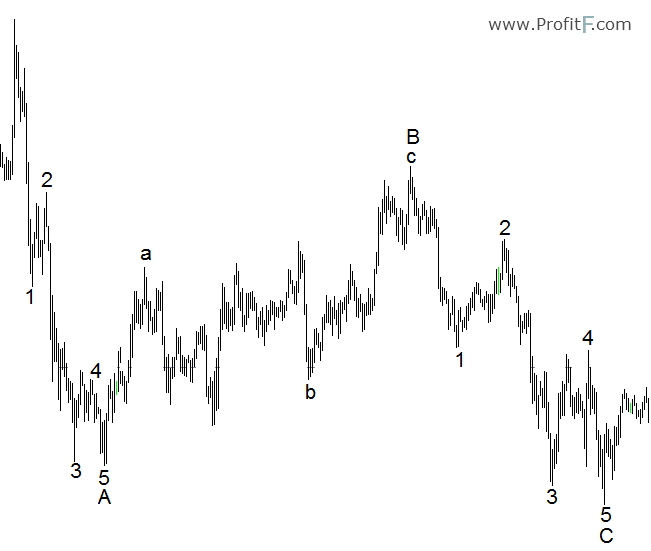

By studying 75 years of past market data, Elliott noticed that prices make five swings in the direction of the larger trend and only three swings against it. Those swings he called “waves”. If the trend is moving up, there are five waves in the upward direction and three downwards. If the trend is moving south, the Elliott Wave cycle is upside down – five down, three up.

Example of the 5-3 cycle is given below:

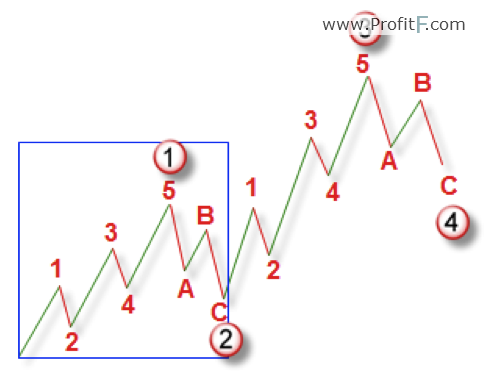

Furthermore, he found out that this 5-3 Elliott Wave cycle can be found on all degrees of trend. It stays the same, regardless of whether we are looking at a yearly or a five-minute chart.

Motive and corrective phases

The motive phase of the cycle is called an “impulse” and is labeled 1-2-3-4-5.

The corrective phase can be just a “correction”, labeled with a-b-c.

The basic principle of Elliott Wave Theory: Motive waves – 5 wave patterns in the direction of one larger degree trend, Corrective waves – 3 wave patterns in the opposite or counter direction to the trend of the next larger degree. (There are a few exceptions and variations, which will be discussed in this article)

Each wave of the five-wave sequence is constructed of smaller waves. Waves 1, 3 and 5 are impulses. waves 2 and 4 consist of only three waves.

3. Motive Waves

The impulse consists of five waves. Impulse waves always has same direction as the larger trend

3.1 Ideal Impulse Wave:

3. 2. Three main rules for impulse waves in Elliott Wave theory

There are 3 main rules, which anyone who wants to make an Elliott Wave analysis must know.

See an example below:

![]()

3.3. Extension

Most impulse waves contain what in Elliott Wave Theory calls an extension. Extensions Elliott waves – impulses with exaggerated sub-waves. The most commonly extended wave – 3th wave

Here an example of extensions in all 3 motive waves:

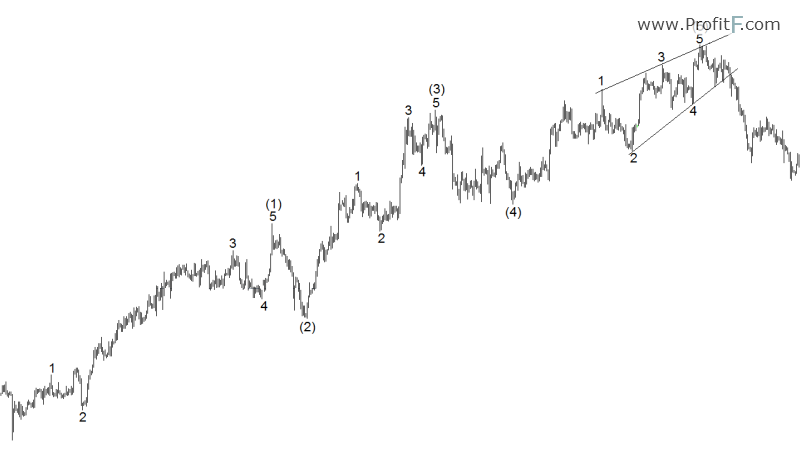

3.4 Truncation

The good thing is that 90% ot the impulsive waves look like on the above-shown charts. But in some cases there could be surprises. The first alternative is the truncated fifth wave or simply “truncation”.

Wave 5 doesn’t exceed the end of wave 3

Everything looks just like a regular impulsive five until we reach the fifth wave. Labeled (5). It does not make a new extreme above or below wave 3. An example is given below.

As you can see, the neccesary five waves are here, but wave five falls short. In order to say that a truncation has occured, you have to be able to count five sub-waves in it.

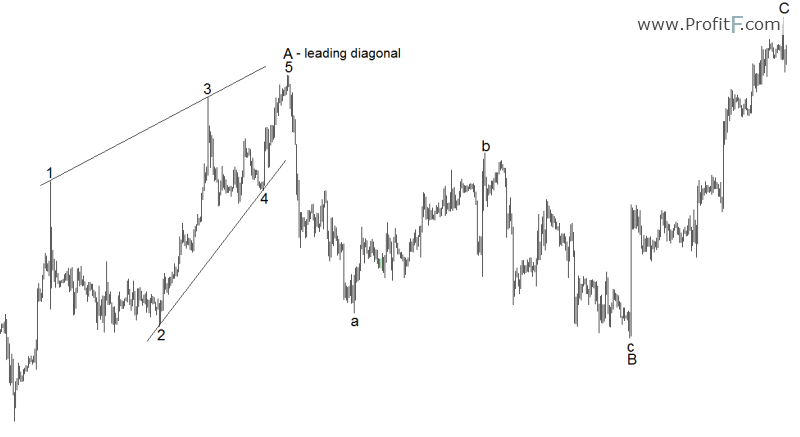

3.5. Diagonals

The other interesting case is the “diagonal”. The diagonal is a pattern, consisting of five waves like in a regular impulse, but waves 1 and 4 tend to overlap. Diagonals develop between two contracting trend lines. You can find a diagonal either in the begining or at the end of the sequence. This means waves 1/A or 5/C.

If the diagonal occurs at the start we call it “leading diagonal”.

If it is in wave 5 or C – “ending diagonal”.

Ending diagonal

Leading diagonal:

On the first of the two charts above you can see an ending diagonal, since it is in wave C of an A-B-C zig-zag. The second chart depicts a leading diagonal in the position of wave A of the same type of pattern.

In a five-wave impulse, the ending diagonal in wave 5 looks like the one

This is pretty much all you need to know about the motive phase of the Elliott Wave cycle – impulses and diagonals. But now comes the difficult part – corrections:

4. CORRECTIVE WAVES

According “Elliott Wave theory”. There are three basic types of corrections:

Zig-zags (Simple, double and triple zig-zags)

Flats (Regular flat, Expanding flat, Running flat )

Triangles

Double and Triple Threes

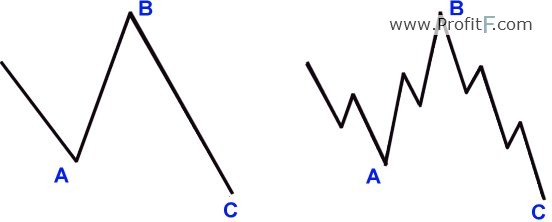

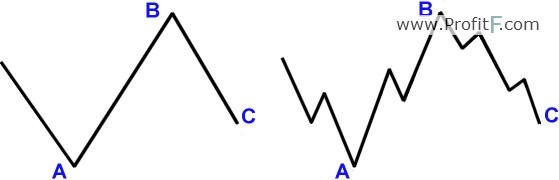

4.1 ZigZags (5-3-5)

Simple, Double and Triple zig-zags

Simple zig-zag is the most common type of corrective pattern. It consists of three Elliott waves, labeled A-B-C. The wave structure is as follows: 5 waves for A, 3 waves for B, 5 waves for C.

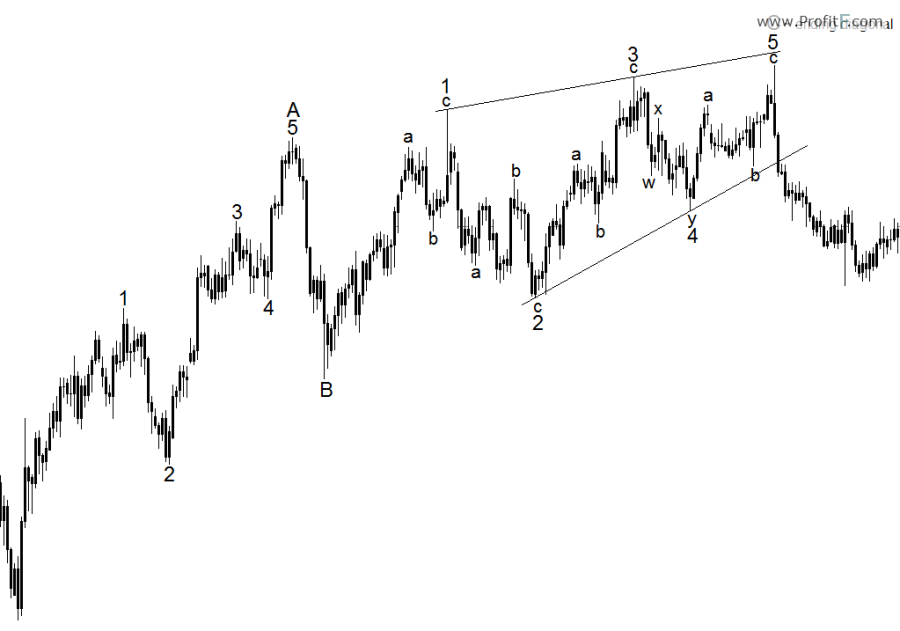

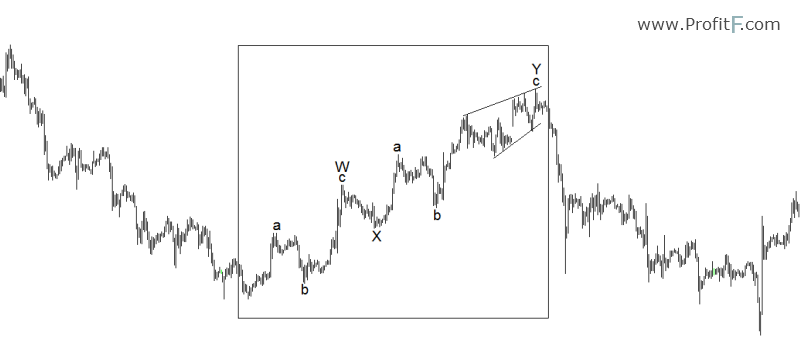

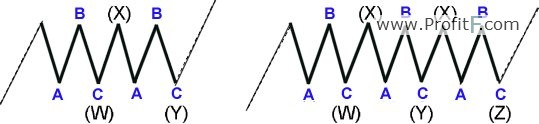

Double zig-zag

Sometimes a single zig-zag is not enough for the whole correction to be completed. In those cases the Market connects the first zig-zag with a second one through an X wave in between. The whole pattern is called “double zig-zag”, labeled W-X-Y, with a wave structure a-b-c for W, a-b-c for X, a-b-c for Y.

Triple zig-zag

And if the double zig-zag is not complecated enough to scare us out, it could evolve into a triple zig-zag, by adding another X wave, connecting Y with Z.

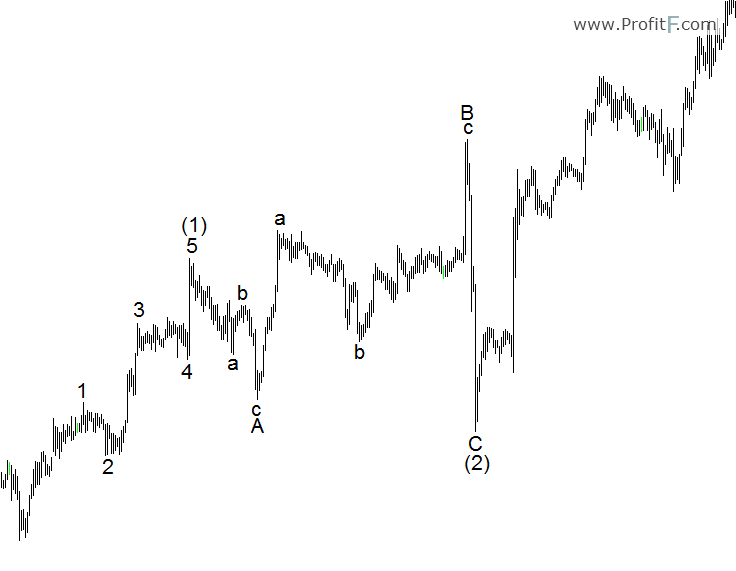

4.2 Flat Corrections (3-3-5)

“Flat” is a term used for three-wave sideways corrections. It consists of three-waves, labeled A-B-C. The wave structure is: three waves for A, three waves for B and an impulse for C. One very important rule about every flat correction is that its wave B must retrace at least 90% of wave A. There are three types of flat – regular, expanding and running. The only difference between them is in their shape, while the wave structure stays the same.

Regular flat

On the chart below you can see all characteristics of the regular flat. Pay attention to the depth of wave B compared to wave A. The 90% rule is fulfilled, but there is no new bottom. Wave C makes a new top, above the end of wave A.

Expanding flat

The only difference between the regular and the expanding flat is the fact, that its wave B exceeds the length of wave A. In other words, the forces behind the larger trend are so powerful, that wave B makes a new extreme – top or bottom, depending on the trend direction.

Below you can see how the classical expanding flat looks like in the wave (2) position. Wave B with a new top above the top of wave (1), which is also the start of wave A of the expanding flat. Wave C goes back below the end of wave A to bring the whole correction to an end.

Running flat

Here the trend, which is interrupted by the running flat is even more powerful. The new extreme in wave B is present during the running flat as well, but this time wave C could not reach the end of wave A..

Below you can see uptrend, interrupted by a running flat in wave (B). You can see its wave structure. Wave A consists of a-b-c, wave B is made by an a-b-c to a new top, followed by wave C to the downside, which ends well above the bottom, left by wave A.

4.3 Triangles

Triangles are sideways corrective patterns, which consist of five waves, labeled A-B-C-D-E. Each wave of the triangle has three sub-waves, so the wave structure of the triangles is 3-3-3-3-3. To highlight a triangle, you have to connect wave A with C and wave B with D. One very important characteristic of any triangle is that it preceeds the final movement of the trend of the larger degree. This means that a triangle could occur only in the position of wave 4 of an impulse, wave B of an A-B-C correction or as a final wave X in double or triple zig-zags. An example of the common contracting triangle is given below. Triangles are not always contracting. Sometimes they expand. So instead of getting narrower with each wave, the triangle is getting wider.

When we see a triangle developing, this means that we should expect one last movement of the current trend, after which a reversal should follow.

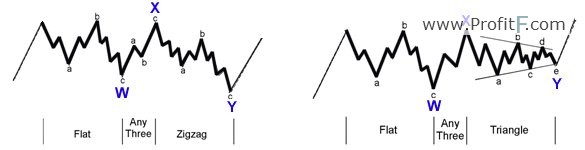

4.4 Double and Triple Threes

Double threes” and “Triple threes” (W-X-Y or W-X-Y-Z) combinations of corrective patterns. Combination of simpler types of corrections ( zig-zags and flats).

Usually a combination includes a flat and a zigzag (or an additional three of some kind in a triple three). But sometimes combinations also includes triangles. A triangle is a final component of these combinations.

5. Principle of alternation

According to the principle of alternation the 2th and the 4th corrective waves within an impulse wave will alternate (in form and depth)

For example, If the 2th wave is a simple corrective wave (e.g. zigzag) the 4th wave is likely to be a not simple, but complex corrective wave (for example, triangle).

If the 2th wave has retraced 50% of wave one, 4th wave will probably retrace only 38.2% of wave three.

6. “Elliott Waves” – Psychology

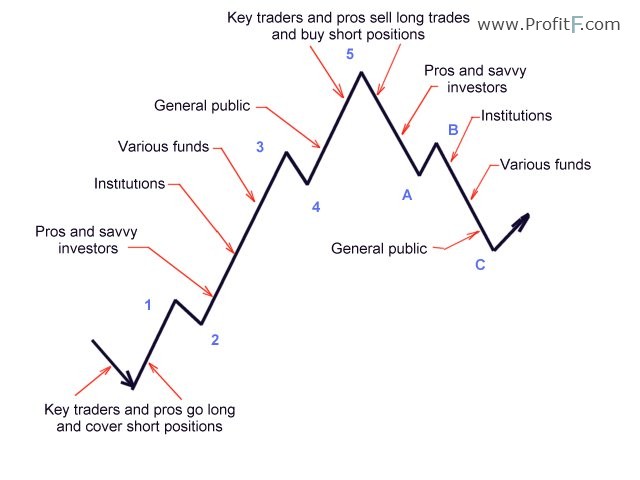

By R.N. Elliott theory WAVES reflects the psychology, sentiment of the crowd. Different psychologies of investors creates the various wave actions.

This picture describes where the differing types of investors decides to get in and out of the market.

7. Conclusion

These are the patterns Elliott discovered some 80 years ago. Since the Elliott Wave theory is a law of nature, they are still applicable today with the same success rate. If you have been following everything till now, you have probably noticed the Wave Principle’s ability to forecast reversals. This is maybe its best quality. While the majority of traders and investors simply rely on the trend, Elliotticians have an edge of being able to prepare for a probable change in the trend’s direction. We do not say that the method is easy to learn and apply, but if you work and study hard, we promise it will become your favorite.

Add your review