JPY currency symbol

Japan is the third largest economy in the world. It is a manufacturing powerhouse and is an export-oriented economy. For the past 20 years, JPY currency has become the favourite currency for the carry trade, where, investors borrow at very low interest rates in Japan and invest in high yield securities in other parts of the world. JPY currency has seen some wild gyrations during the last century and, therefore, makes for an interesting study. In this article, we will follow the journey of the Yen from its inception till date.

History of currency in Japan

First coin

During the 7th century, trade between Japan and China increased, this lead to the first Japanese embassy being set up in China. Many cultural exchanges are thought to have happened during that time. China was already using coins from early 7th century. The Japanese traders and noblemen appreciated the value of the coinage and adopted it. The first official coin in Japan was minted in the year 708. The coin was modelled similar to the Chinese coins. Over the next few centuries, Japanese mints stamped copper, silver and gold coins.

Return to commodity currency-Rice

There was large scale minting of the coins and local versions which led to a reduction in its value. By the 9th century, the value of the coins’ basis rice was only 1/150 compared to the 8th century. This led to a loss of confidence in the currency and finally a return to the commodity currency rice. By the 10th century, rice was being widely used all over Japan.

Re-introduction of coins

Trade was expanding making it difficult to use rice as currency, and the traders returned to using coins again. The coins in Japan were now a poor replica of the Chinese coins. These imitation coins continued from 12th to 16th century. In 1601, the Tokugawa coinage was established by Shogun Tokugawa leyasu which minted gold, silver and bronze coins. This was in use for about two centuries. When Japan opened its doors to western nations in 1854, the Tokugawa system crumbled.

Arbitrage due to different gold to silver swap ratio

The gold to silver swap ratio in Japan in 1854 was 1:5 whereas in the west it was at 1:15. This led to huge arbitrage by the traders and led to a loss of huge quantity of gold to the Japanese. The Mexican dollar was given the status of official currency in 1859. During the same period of 1859-1869, the local governments printed their own currency which increased the money supply two and half times. This led to a widespread increase in prices and chaos.

Yen

The birth of the Yen took place during 1868 under the Meiji government. The government of the time introduced a new currency and feudal notes but allowed the earlier currencies to be used too. Counterfeiting became rampant which led to confusion and chaos. Eventually in 1871, Japan decided to join the Gold Standard with 1 Yen valued at 1.5 grams of gold.

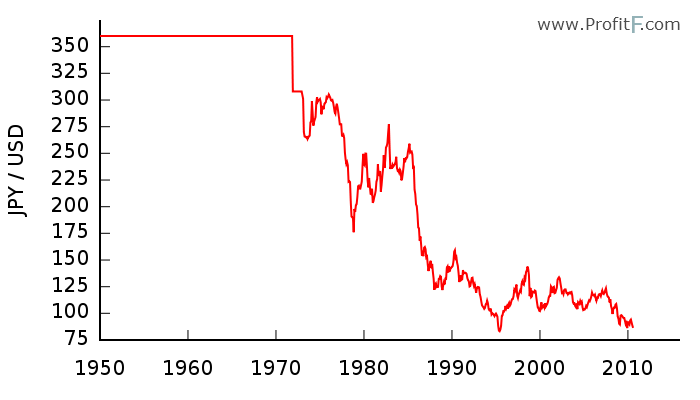

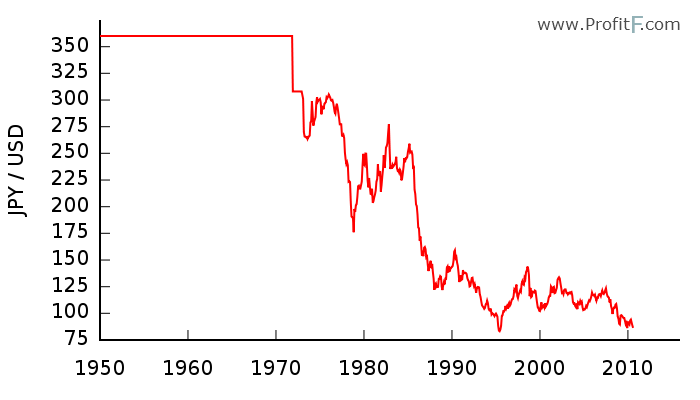

Historical chart of Yen vs the US dollar

The Yen traded at $0.5 in 1897 and with Japan joining the Gold standard, the rate was fixed till 1931 when Japan left the Gold standard. The rate gradually fell to $0.3 at the start of the WW II, and post that it dropped to $0.23 in value. With Japan joining the war, inflation reduced the value of Yen further.

Post World War II

After the war ended, Japan needed help to rebuild its devastated economy. As part of the Bretton Woods System, the US fixed the price of the Yen at ¥360 for $1 in 1949. The Japanese economy grew and the Yen gradually got undervalued. The current account deficits turned to current account surplus. The Japanese exports were costing too little and the US was forced to take action and abandon the Bretton Woods system and abandon the Gold Standard.

Plaza Accord and Asset bubble burst

A new exchange rate of ¥308 for $1 was agreed upon, however, with the pressures in the market this could not continue and by 1973, the Yen was allowed to float freely. The Yen strengthened to ¥239 by 1985. The Plaza accord was reached among the G5 nations wherein a change was sought as the US dollar was presumed to be overvalued, thereby the Yen strengthened to ¥128 by 1988 almost doubling in value in three years. The Yen continued to strengthen to around 80 levels by 1995, but when the Japanese asset bubble burst in 1998 the price weakened to ¥147 levels.

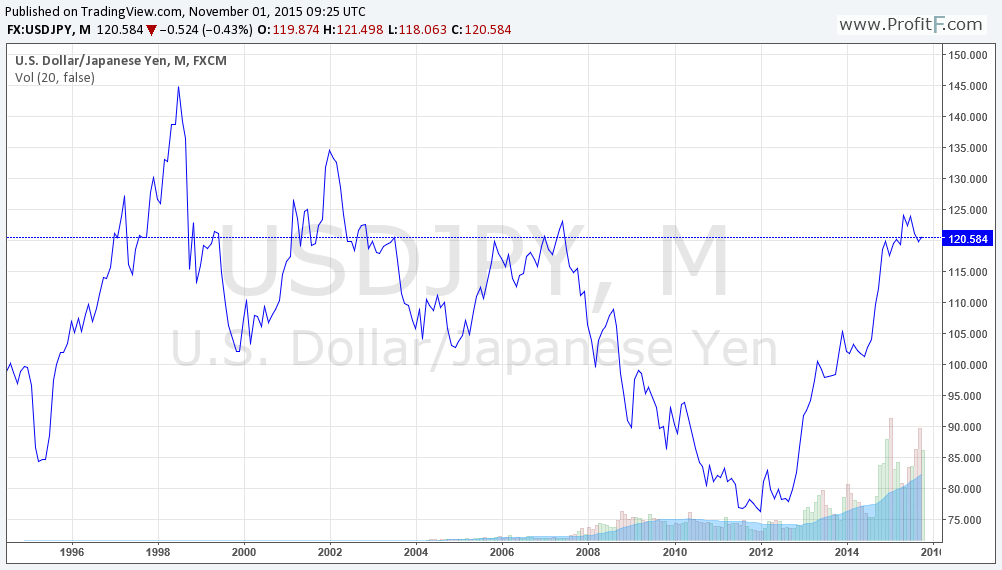

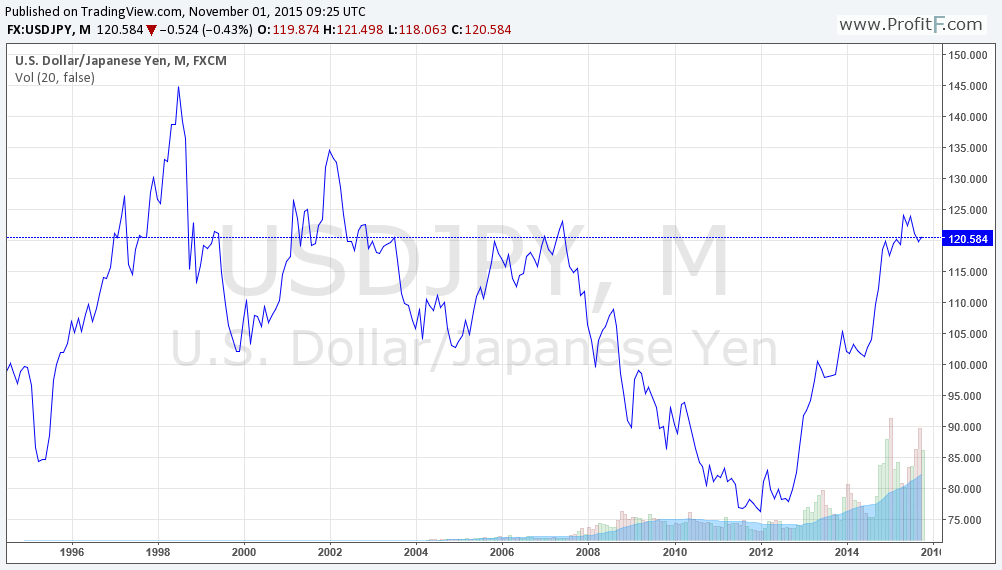

USD/JPY chart 1998 to present

The movement of the JPY currency from 1998 to present is shown in the chart below.

The chart above shows the price of the Yen against the US dollar from 1998 to present. As seen the Yen strengthened to ¥75.5 in 2011 after the Housing bubble burst in the US in 2007. Since then the Yen has weakened to present levels with an improvement in the US economy and the start of Abenomics.

Why is the Yen considered as a safe haven

During times of financial crisis in the world Yen is considered as a safe haven investment. A few of the reasons being the current account surplus Japan runs. It has more investment overseas compared to foreign investment into Japan. The debt of Japan is mostly internal and is held with the domestic investors thereby reducing its risk. Japan also happens to be one of the largest creditor nations of the world. Therefore, during crisis traders buy the Yen increasing its demand.

What moves the JPY currency

Japan is a manufacturing powerhouse and depends on its exports for the health of its economy. A high manufacturing, mining, and utility index supports the Yen. The GDP, the Tankan Survey, and the unemployment numbers are also closely watched for the movement of the Yen. China and the US are the biggest trading partners to Japan. Policies in both the nations which can have a bearing on the exports from Japan might affect the movement in the Yen.

Yen in Forex trading and as a reserve currency

The symbol of the Yen is ¥ and is known as JPY in the Forex markets. According to Wikipedia, the Yen is the third most traded currency by value in the Forex market with 23% of the turnover. The JPY currency is part of the reserve currency basket and is the fourth most held currency as reserves by the Central Banks; it has a 3.8% share in 2015 which is down from a level of 6.8% in 1995.

Future of the Yen

After the last decade of low growth and deflation, the Japanese Prime Minister Shinzo Abe has ushered a set of reforms famously termed as Abenomics. It has a three-point agenda to increase money printing to make Japanese exports more attractive and also increase inflation after years of deflation. The second point is to stimulate demand via government spending. The third is to usher in industrial, labour and agricultural reforms, and regulations to improve their functioning. The success of Abenomics is necessary for the health of the Japanese economy.

Japan is also among one of the oldest nations in the world. With a decrease in working population, it is expected that the economy might face some headwinds.

Conclusion

Japan is one of the first developed nations in recent history to have faced a massive asset bubble burst, which led to lost two decades. The present leadership has aggressive plans to return back to a strong growth trajectory. It takes time to turn around the third largest economy in the world. Only time will tell if the recent efforts were successful or not. Traders will do well if they keep an eye on the data to look for green shoots in the Japanese economy.

(8 votes, average: 4.25 out of 5)

(8 votes, average: 4.25 out of 5)

Add your review