The Alligator indicator, introduced by Bill Williams in 1995 comprises of three lines that is overlaid on the main price chart. The Alligator’s components are commonly referred to as the jaw, teeth and lips. The alligator indicator is used to confirm trends and signal potential changes to the trend.

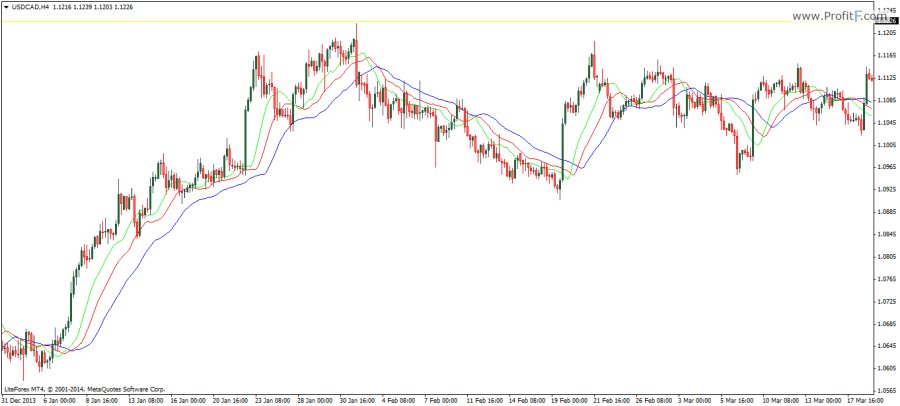

The indicator gets its name as Alligator as the three lines tend to expand and close to intertwine, which represents the opening and closing jaws of the alligator. When the three lines (Jaw/Teeth/Lips) start to cross over each other, it is referred to as the sleeping alligator. When the alligator is in this ‘sleeping mode’ it indicates a potential period of ‘hunger’ as the Alligator starts to open its jaws.

The default settings for the Alligator indicator is 13, 8, 5; which are nothing but three moving averages which are displaced 8, 5 and 3 periods into the future. In a way, the Alligator indicator is nothing but trading the crossover of three displaced moving averages applied to the median price.

As with most moving average based indicators, the Alligator indicator must be used alongside other oscillators such as the MACD or RSI in order to time the markets accordingly. The use of three moving averages however greatly reduces the number of false signals that arise out of using just two moving averages.

Add your review