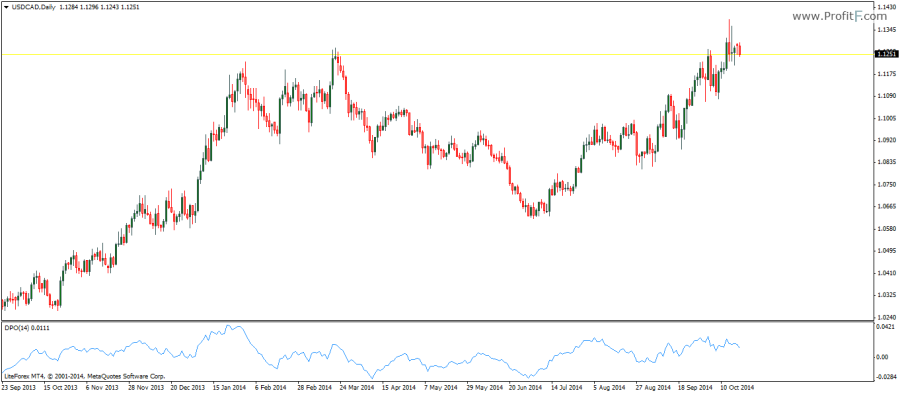

The Detrended Price Oscillator indicator or DPO for short was first discovered in Steven Achelis’ book, Technical Analysis A – Z. The DPO indicator is used to identify the short term market cycles. The indicator is calculated based on comparing the closing price to a previous value of the moving average. The DPO comes with a default setting of 14 periods with the cycles measured for the past 300 price bars both of which can be easily customized to suit the trader’s preferences and/or market conditions. It is a widely accepted rule that a cycle period of less than 21 periods tends to work best for identifying turning points in the short term.

The DPO therefore is an indicator used to measure cycles and not to be confused with measuring momentum or trend change.

The DPO indicator has some distinctive signals. The most commonly used signals are when the DPO makes a higher trough, it indicates an upturn in the short to medium term cycle and likewise, when the DPO makes a lower peak, it signifies a downturn in the short to medium term cycle. Besides the above signals, other ways to trade the DPO includes taking a long position with the DPO turns above 0 after falling below the 0-line and to go short when the DPO rises above 0 and declines below 0 again

Download Detrended Price Oscillator

Add your review