PROC indicator (Price Rate of Change) measures the cycles in the markets by closely monitoring price changes. In a broad sense, the Price rate of change works on the same principles of the Volume Rate of Change or VROC indicator, with the main difference being that price is considered in the PROC indicator.

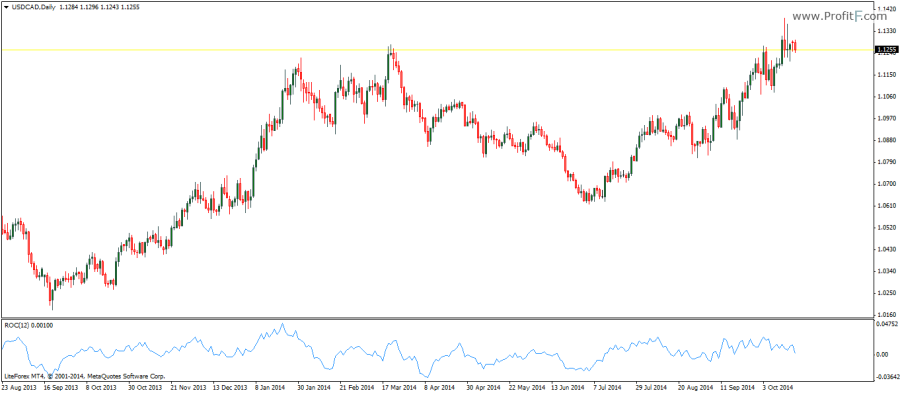

The ROC indicator comes with a default 12 period look back settings, besides 25 period ROC being also one of the more widely used settings. The PROC oscillator moves above and below 0-line and as with most oscillators, the ROC’s movement above and below the 0-line signals long and short positions. Divergences are also another common way to trade with the ROC oscillator. The calculation of the ROC indicator is based on dividing the difference between current price to price of the past look back period to the price of the past look back period multiplied by 100.

Some customizations of the ROC can also take into consideration the percentage changes as well. As with volume rate of change indicator, the PROC indicator also precedes price movement, in that the ROC tends to peak and bottom before price. When this anomaly is found, trade signals can be generated accordingly.

Add your review