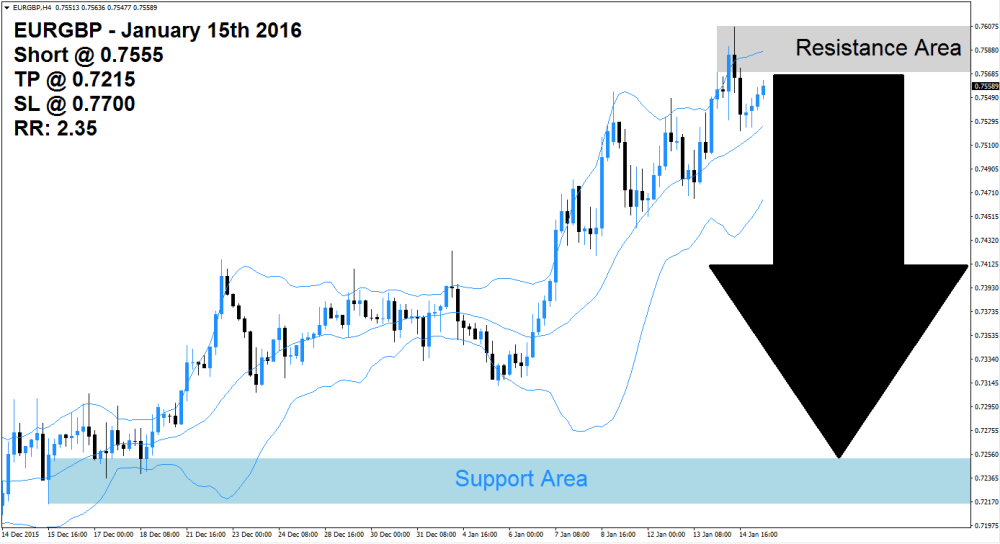

The EURGBP has rallied from its support area, which is marked in light blue in the above H4 chart, into its resistance area visible in light grey. Once price action was unable to pierce through its resistance area, sellers stepped in and pushed this currency pair below its resistance area, but the EURGBP continues to trade between the middle band and the upper band of the Bollinger Band indicator which supported the rally.

The EURGBP has rallied from its support area, which is marked in light blue in the above H4 chart, into its resistance area visible in light grey. Once price action was unable to pierce through its resistance area, sellers stepped in and pushed this currency pair below its resistance area, but the EURGBP continues to trade between the middle band and the upper band of the Bollinger Band indicator which supported the rally.

Since sellers have increased their activity, forex traders with long positions in this currency pair may opt to realize floating trading profits by closing existing long positions following the breakdown below its resistance area. Once the EURGBP dips below the middle band of the Bollinger Band new net short positions are likely to follow which could take the profit taking sell-off back down into its support area. Downside potential remains attractive with limited upside potential in the short-term.

Forex traders are advised to enter short positions at 0.7555 and above in order to be well position for the expected profit taking sell-off in this currency pair and a break in the up-trend. Conservative forex traders should wait for price action to break down below the middle band of its Bollinger Band Indicator which will increase selling pressure. A take profit target of 0.7215 has been selected for a potential trading profit of 340 pips.

Forex traders should protect this trade with a stop loss level at 0.7700 for a potential trading loss of 145 pips which will result in a Risk-Reward (RR) ratio of 2.35.

EURGBP

Short @ 0.7555

TP @ 0.7215

SL @ 0.7700

RR: 2.35

Add your review