EURUSD trading plan.

Sell pullbacks up to 1,135, with take profits to 1,103, 1,095, 1,0.

Last week the euro lost more than 300 following the ECB rate decision and some comments from ECB President Mario Draghi. As a result, the weekly chart shows a huge bearish candle, that confirms the rejection of a triangle resistance at 1,145 and landed on the triangle support trend line around 1,1. It broke several other supports in the process, and those are now the resistances where I am going to look for selling signals. On this chart see the 20 and 40 SMAs are located around 1,115, with an horizontal resistance at that level. This is the point where my ultimate stop will be located for short trades.

EURUSD WEEKLY CHART.

There are three fibonacci retracements we may consider using, to find resistances levels on the daily chart. They all show the same thing: one level is located around the 1,115 level, with the 200 SMA standing near, and the next levels are located between 1,125 and 1,135.

The first retracement shows the 61,8 level around 1,115 and the 50 level around 1,125.

EURUSD DAILY CHART 1.

But we may consider a second possible, tighter retracement. The 61,8 resistance is a little higher, and the 50 retracement stands around 1,128

EURUSD DAILY CHART 2.

And a last retracement shows the 0,786 resistance around 1,115, and the 50 around 1,136. In that case we are retesting the retracement support.

EURUSD DAILY CHART 3.

Which one is the good one ? Nobody knows, but the H4 chart will give us some other clues about what may happen.

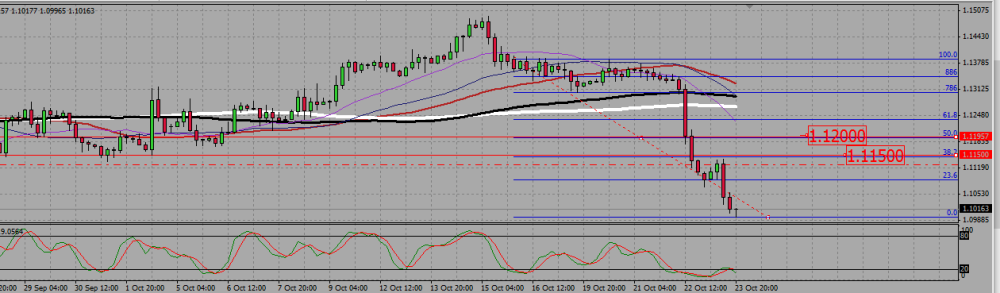

On the H4 chart we see more clearly the Thursday/Friday bearish move. It shows its 50 fib resistance level is around 1,12. A 38,2 level is located around 1,115. I prefer to consider my last stand stop there for it is the only level that is resistance on every time frame. Above it I will also consider longing the pair to go back to the 1,12, 1,125, 1,135 , and 1,145 resistances.

EURUSD H4 CHART.

AUDUSD trading plan.

One chart says it all.

AUDUSD DAILY CHART.

On that daily chart, the 200 and 100 SMAs are pointing down, meaning we are in a bearish trend, but the pair found support around 0,69 and is now climbing back in a bullish consolidation -note how the 20 SMA is starting to point north-. The aussie managed to gain 400 pips and went as high as 0,735 before being blocked by the 100 SMA resistance which sent it back to the 0,72 support. It now looks like stuck over that support, with two doji candles on Thursday and Friday.

If the 0,72 support is broken -after all we are in a down trend-, the pair will probably go back to the 0,69 support level.

If it holds, a bullish breakout of the 100 SMA would open the way to a retest of 0,735 and above it to a reach for the 0,76 level, where I will look fore the bearish trend to resume. I will however pay attention to the 200 SMA (the white line), as it also may prove a tough resistance to pass.

Add your review