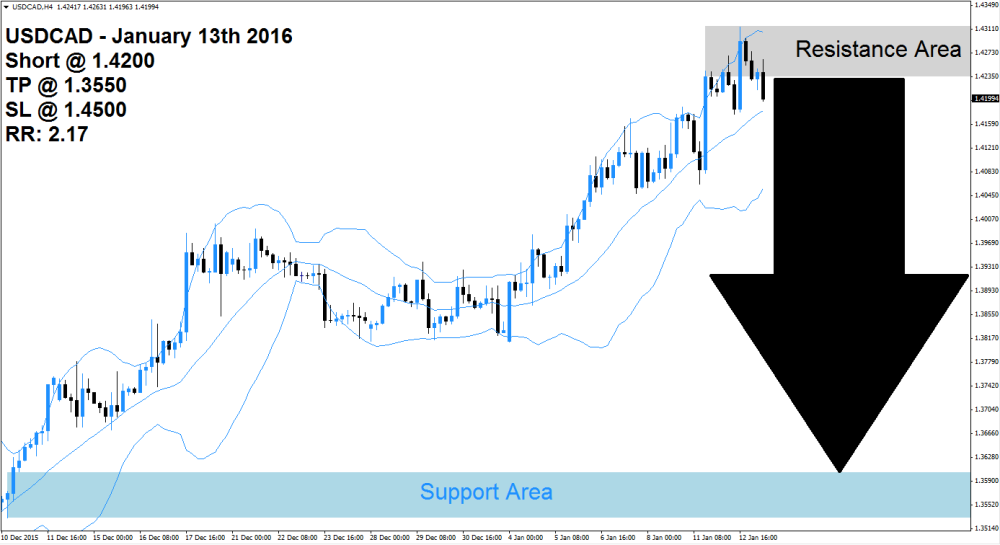

The USDCAD is struggling to extend its gains and forces where strong enough to push this currency pair below its resistance area which is visible in light grey in the above H4 chart. The string rally which formed from its support area, marked in light blue, was support by the Bollinger Band indicator. The lower band prevented a breakdown and during the last leg higher, the middle band provided the required support to push the USDCAD ahead.

The breakdown below its support area could invite forex traders to realize floating trading profits in this currency pair by closing existing long positions. This will result in a profit taking sell-off which could lead to a breakdown below the middle band from where new net short positions are possible. This can turn the profit taking sell-off into a wider correction and the USDCAD may retrace at least 50% of its current rally.

Forex traders are advised to enter short positions at 1.4200 and above in order to be well position for the expected profit taking sell-off in this currency pair and a break in the up-trend. Conservative forex traders should wait for price action to break down below the middle band of its Bollinger Band Indicator which will increase selling pressure. A take profit target of 1.3550 has been selected for a potential trading profit of 650 pips.

Forex traders should protect this trade with a stop loss level at 1.4500 for a potential trading loss of 300 pips which will result in a Risk-Reward (RR) ratio of 2.17.

USDCAD

Short @ 1.4200

TP @ 1.3550

SL @ 1.4500

RR: 2.17

Add your review