Breakout-55 – Strategy that use of just the 45 period EMA and no other indicators. It works on the concept of break out and is very simple. However, only experienced traders are better suited to trade this strategy as break outs can often result in a fake out with price reversing back to its previous trend. This strategy works on both H4 and daily time frames and therefore it is not an intraday strategy.

Strategy Set Up

Recommended Broker >>

Breakout-55 Strategy Rules

Long Set up:

- Price closes above the 55 EMA

- Second candle after the close should also be bullish

- Buy on the third candle

- Set stop loss to a few pips below the 55 EMA

- Take profit will be 60 – 80 pips if using the H4 time frame or 150 – 200 pips if using the daily time frame

Short Set up:

- Price closes below the 55 EMA

- Second candle after the previous close is also bearish

- Sell on the third candle

- Set stop loss to a few pips above 55 EMA

- Take profit would be 60 – 80 pips if using the H4 time frame of 150 – 200 pips when trading on the daily time frames

Strategy Examples

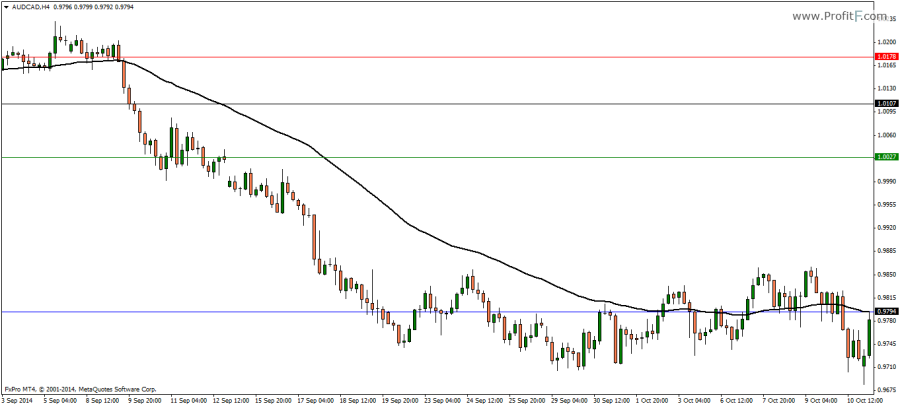

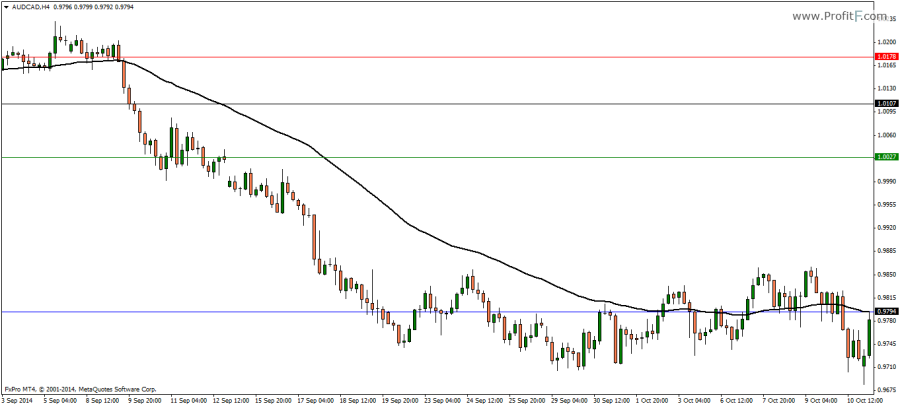

Short Set up

- Price breaks below the 55 EMA

- After two bearish candles, a sell order is placed with a 80 pips in take profit and stops placed just above the 55 EMA

- Trade results in a profit

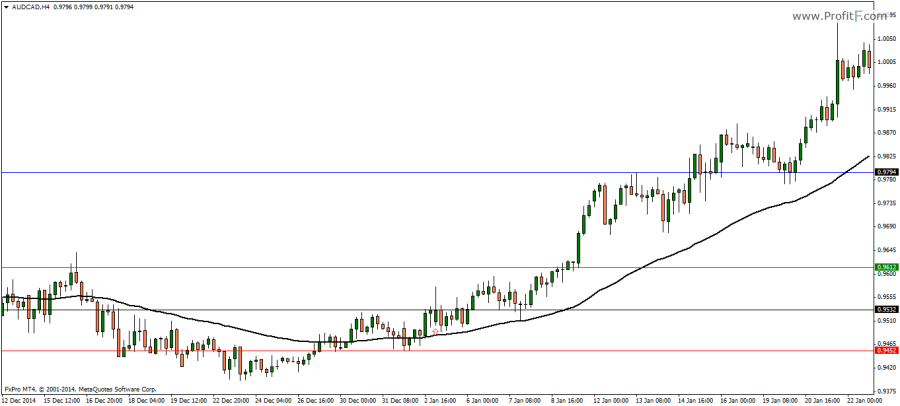

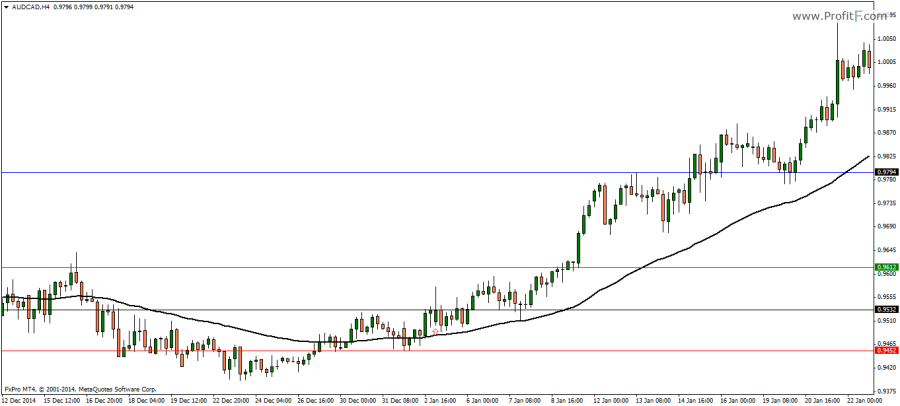

Long Set up

- Price breaks above the 55 EMA

- After two consecutive bullish candlesticks, a buy order is placed with 80 pips in take profit and stops placed just below the 55 EMA

- Trade results in a profit

Conclusion

The 55EMA breakout strategy is one of the simplest break out trading strategy that works best on H4 or daily charts. However, despite the simplicity, this strategy requires quite some experience in knowing how to identify a break out from a fake out.