TrendLine with MACD 12, 26, 9 Strategy trading strategy combines a mix of indicators and price action trading. This combination of trading methods gives rise to one of the most reliable trading strategies that one can trade. It however requires a bit of practice to get accustomed to this trading strategy. The trend line and MACD trading strategy works on all time frames.

Strategy Set up

- Trend lines

- MACD (12, 26, 9)

Recommended Forex broker – EagleFX

Strategy Rules

Long Set up:

- Connect the swing highs using the trend line

- When price breaks the trend line, MACD must be above 0

- Enter long with take profit of 40 – 50 pips with stop loss of 40 pips

Short Set up:

- Connect the swing lows using the trend line

- When price breaks the trend line, MACD must be below 0

- Enter short with take profit of 40 – 50 pips with stop loss of 40 pips

Strategy Examples

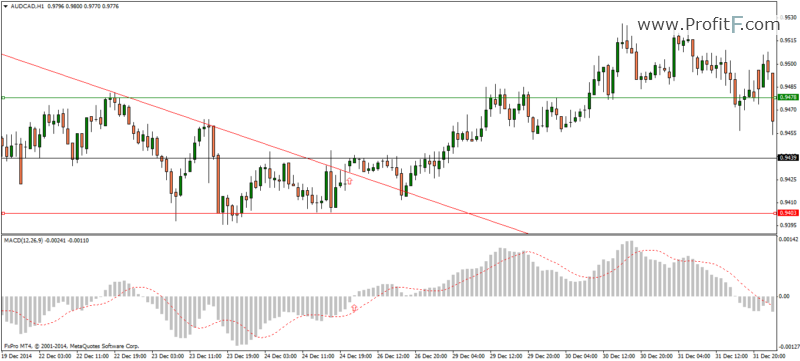

Long Set Up

- After connecting the swing highs with a trend line, we notice price breaking out from the falling trend line

- We take a long position after the MACD rises above 0-line

- Stops are placed approximately 40 pips lower while take profit is set to 40 – 50 pips

- The above trade resulted in a profit

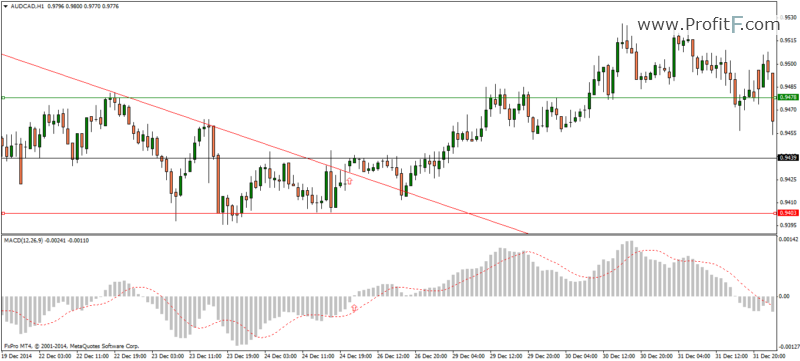

Short Set up

- The trend line is used to connect the swing lows. Price then break out from this rising trend line

- MACD also turns below the 0-line

- So a short position is taken up, with a 40 pip stop loss and a 40 – 50 pip take profit level

- Trade resulted in a profit

Conclusion

The trend line and MACD trading strategy is very simple and a straightforward trading strategy. The strategy is very basic and thus has a lot of scope for traders to modify this strategy to suit their requirements.