TABLE OF CONTENTS:

When you have been trading for a while, there is a tendency to become just a little proud. It is hard not to feel a little proud sometimes, especially if you are an experienced and Forex successful trader! However, pride dulls the mind and makes you less likely to pick up on lapses in performance until it is too late. It also creates a false sense of security when you need to be paying attention to the markets! What are the warning signs of an inflated ego and how can you overcome your arrogance? Here are some common symptoms and solutions to help you stay humble and on top of your game.

While you may have improved your ability to flawlessly execute trades, a telling sign that you may be getting too big for your boots is when you think you can predict the market. Although adopting a trading strategy increases your chances of success (because you are strategically taking only the best trades while limiting downside risk), it is prudent to remember that losses are part and parcel of trading. Being able to flawlessly execute your strategy does not preclude the possibility of a losing trade. You will not be guaranteed success every time and you do not control market direction. You are simply taking a trade based on probabilities and minimizing the downside risk should you be proven wrong.

Rather than focusing on being right, it is probably more useful to focus on mastering your trading strategy and executing it perfectly each time. The central idea behind flawless execution is to minimize diversifiable risk. If you minimize the losses, the profits will take care of themselves.

Another symptom is thinking that you have it all figured out. While feeling comfortable with how you execute your trading strategy is great, there is a fine line between that and mentally checking-out without really thinking carefully about the trades you place. Being mentally disengaged can lead to boredom and overtrading, where traders enter less than perfect trades for want of something to do. There is a difference between having a winning trade because you followed your strategy and having a winning trade simply because you were in the right place at the right time. It is your job to know the difference; markets are dynamic and there is always something new to learn!

To avoid overtrading, it is often suggested that traders consider new markets or alternative styles of trading if they are getting bored with their current options. There are many possible ways to trade and many financial products which you may wish to apply your trading strategy to. You just need to keep an open mind and keep challenging yourself! Don’t stop exploring the possibilities. The Downside of Loving Trading too much

Arrogance can also lead to oversimplification. When every day feels the same, repetitive tasks become drudgery and bad habits can develop. Cutting-corners and thinking everything is easy has been the stumbling block of many a trader! When you find yourself taking shortcuts and being too relaxed about implementing your strategy, your standards are prone to deteriorate, allowing diversifiable risk to creep back into your trading. As a result, it is possible you may start noticing adverse changes to your win-loss ratio; more times when you have been caught without a stop or worse, when a poorly placed stop is triggered before the trade moves on towards its target. What can you do to remedy this?

If the above scenarios have been occurring on a regular basis, you may wish to take a step back, stop trading altogether and review your trade records. Identifying the areas where you have become a bit too complacent is a starting point. Next, you need to unlearn the bad habits and this takes time. At first, it can be embarrassing to admit that there are areas you need to work on, but it is only natural! Nobody was born a good trader. It is a constant learning curve, requiring hard work and dedication like any other profession. The more you learn and the more you progress, the more you realise that you have only begun to scratch the surface!

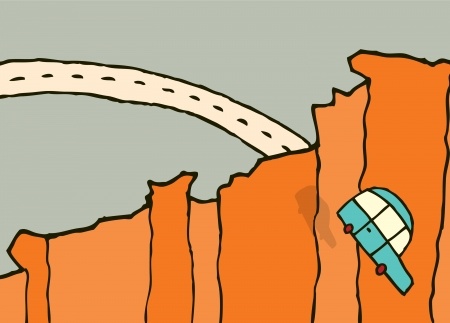

Socrates once said, “I am the wisest man alive, for I know one thing, and that is that I know nothing”. The markets can swiftly make a fool out of the unprepared, and of the people who arrogantly choose to shut an eye to signals which contradict their views. Don’t be like that, stay humble and trade safe! Happy trading!

Philipp Pfitzenmaier

Add your review