| Name | FXMover |

| Website | fxmower.com |

| Type | EXPERT ADVISOR |

| Platform | MetaTrader |

| Developer | Other |

| Statement |

|

| Free |

|

| Price | 220 $ |

| - ProfitF BONUS: |

|

|

CashBack from ProfitF = $20 |

|

FXMOVER forex EA (official website) designed to work on the Metatrader 4 (MT4) trading platform which is widely used because it is free and convenient. FXMOVER is a strategy code for MT4 called also Expert Advisor (EA).

Trading Style – martingale

Developer – Foreximba

Forex pairs – any

TF (TimeFrame) – n/a

Broker – FXMover work with MT4 forex broker

Recommended Minimum deposit – $250

Price – $220 $200 ( with $20 CashBack from ProfitF)

Refund policy – 60 days money back (through AvanGate payment processor) ![]()

So, let`s begin with vendor`s information presented on http://fxmower.com/. The website is well designed andsimplystructured with not so much information about the creator/s of the automated system – it lacks an “About” section. There is not information regarding other EA`s created by the same vendor so I cannot say anything about the credibly of the creator/s.

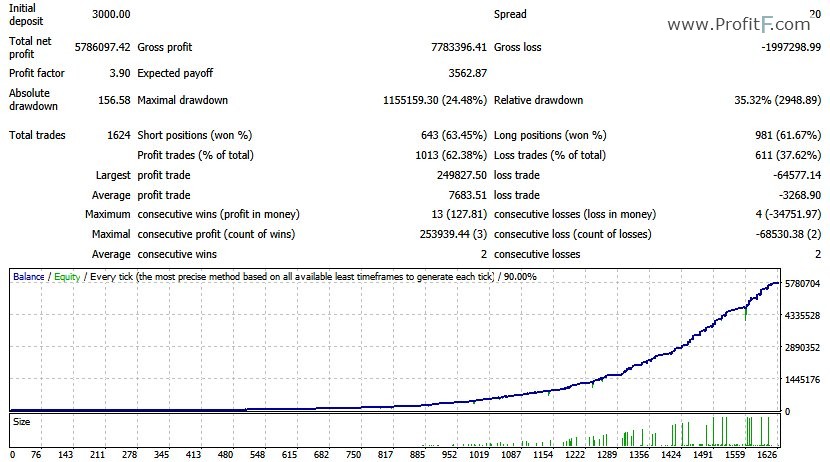

The backtest period of FXMOVER forex robot is form the beginning of 2012 untilthe middle of 2016. You can download the detailed backtest statement which is quite helpful for traders who want to scrutinize trade by trade to understand the strategy more accurately.

Total trades made by EA during the period is 1624 which makes less than 3 trades per week on average. So there will be a lot of days when you won’t see any trading activity produced by the FXMOVER.

The win rate is 63% with an average profit trade of7683 and an average losing trade of 3268. These statistics makes the strategy’s equity curve looks exponential. I have to mention here that one of the contributing factors for such a good-looking chart is the compounding effect which for a 5 years period is quite a big factor.

It is obvious from the MT4 statement that FXMOVER uses Stop Loss and Trailing Stop. SL is usually around 50 pips. Take Profit orders are used when the EA increasesthe lot size after a losing trade, which will be described below.

The backtest has been conducted with 2 pips spread which is a very, very conservative approach because nowadays with most brokers which operate without raw spreads + commissions you could observe 1 pip spread on average during most active trading hours. We have an extra 1 pip in hand which could be subtracted for slippage and other expenses.

The modeling quality of the backtest is 90% which can be much better. It is possible to get 99% quality when doing your test using every tick option on Metatrader 4.

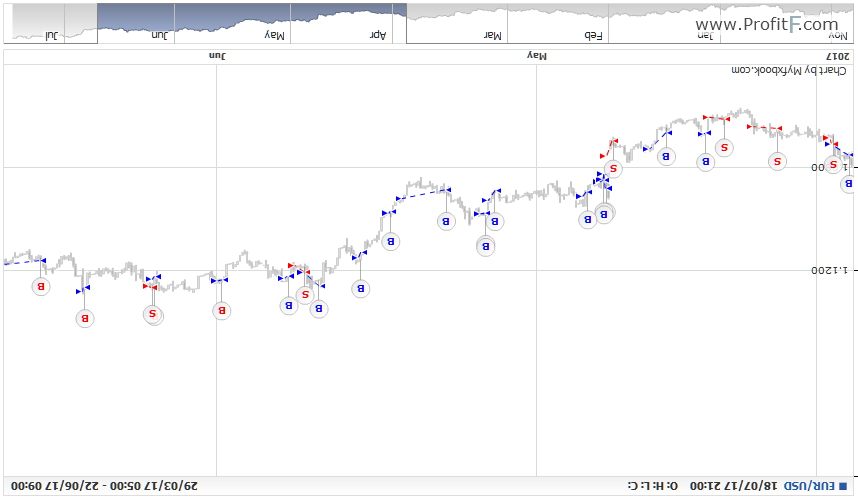

We can find real time strategy results of FXMOVER starting from July 2016. The validity of the real account history is validated by MyFxBook. So far the results are excellent – 874% profit with MaxDD of 27.96%. Take a look at the good-looking equity curve:

It is very steady with no losing months according to MyFxBook. All 13 months of trading history so far are on profit where the best month`s gain is 52.41% and the worst + 2.12%. On average monthly gain is 21.18%.

The low number of trades for the period – 148 is very consistent with thebacktest period which is a good confirmation about the FXMOVER.

On average the trade length is almost 18 hours so it puts the strategy somewhere between day trading and swing trading type.

Is it worth to mention that the Profit factor is 1.65 – a very acceptable one.

To me the FXMOVER is a mix of two Forex trading strategies because looking at the trade by trade on MyFxBook it is obvious that there are trades which are opened on price weakness and trades which are opened during the price strength. Since we don`t have an accurate information about the EA from the vendor himself it is difficult to be 100% sure about the concept behind the creation of the strategy.

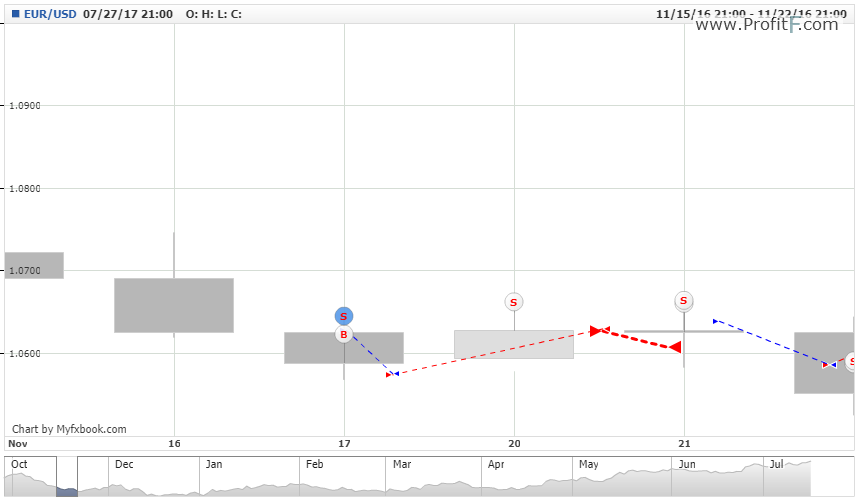

We can be 100% sure though that FXMOVER is using pure Martingale strategy. The first sign of it is when you look at Expectancy on MyFxBook which is -0.8 pips. This means than the trades themselves are net losers but because some of the trades have much bigger impact due to increased lot size (Martingale) we have a positive expectancy when it comes to the Dollar value (+ 29.95$).

How exactly is the Martingale applied is revealed by scrutinizing the trade by trade on FXMOVER. When a trade is closed by Stop Loss the EA is losing around 7- 8% of the equity. So if this happens the strategy enters the market on opposite side immediately when SL is hit with a double lot size than the first trade thus risking 14-16% of the account. If the second trade happens to be a loser then FXMOVER aggressively increases the lot size – 5 times the second trade which is 10 times the first and enters the markets on the opposite direction of the second trade at the moment it is closed. See below an example:

Sometimes the EA as a third Martingale order opens two hedging trades or enter the market in the direction of second trade. (read our helpful article How to buy Forex Robot here ) Since the risk is 5 times the second trade on the third the EA is committing 70-80% of the entire account. Below you can find a summary of the Martingale strategy:

1 trade – risk=7-8%

2 trade – risk=14-16%

3 trade – risk=70-80%

So the total risk for all 3 trades is very close or above 100%. So far on both backtest and forward test the EA has encountered only 2 losing trades in a row. With a possible third the account will be blown. ((

According to the official website the Expert Advisor costs 220$ and it is one-time payment with no subsequent charges. You will be able to use the strategy on one real account and up to 3 demo accounts. The vendor also promises free updates if issued at all in the future.

So far FXMOVER has a very good track record on the real account which is a very good sign. It has to be mentioned though that mostly the good looking equity curve is thanks to the very aggressive martingale money management formula the EA is using. Every trader should be aware of this fact and should carefully consider whether such a risk is suitable for him/her.

Add your review